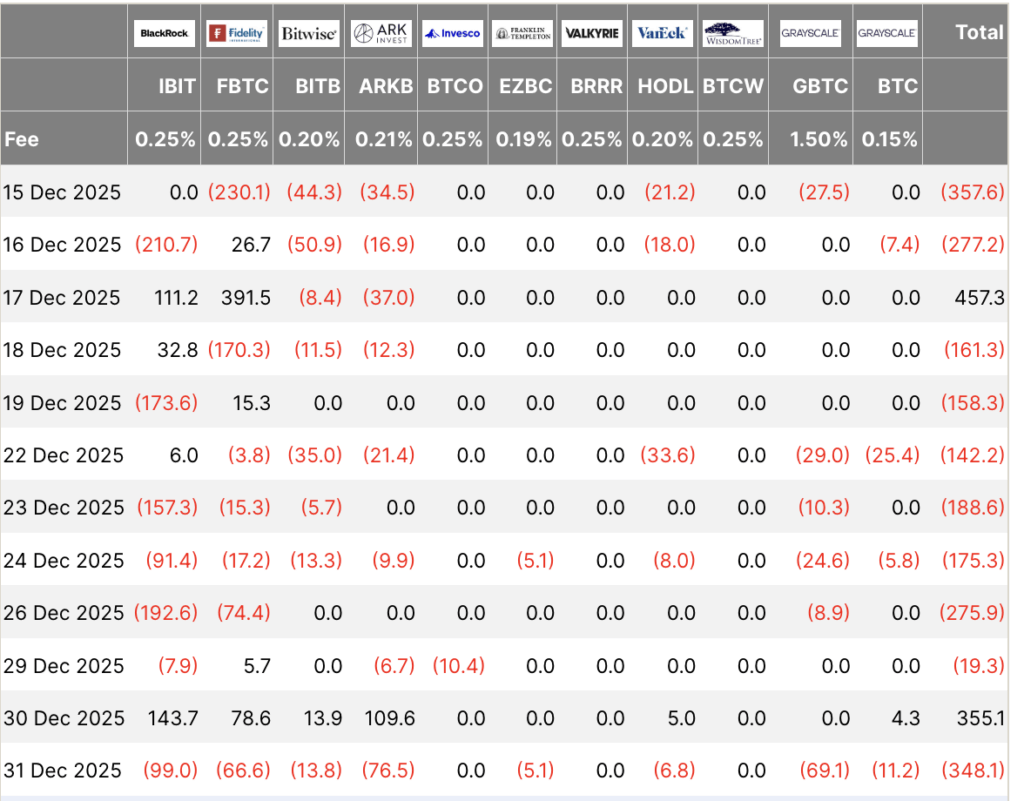

Bitcoin ETFs failed a critical holiday stress test as $1.29 billion vanished through “tactical” positioning

U.S. spot Bitcoin ETFs posted about $1.29 billion in net outflows over the 12 sessions from Dec. 15 through Dec. 31. The quiet holiday stretch became one of the cleaner stress tests yet for how “sticky” the category is when trading

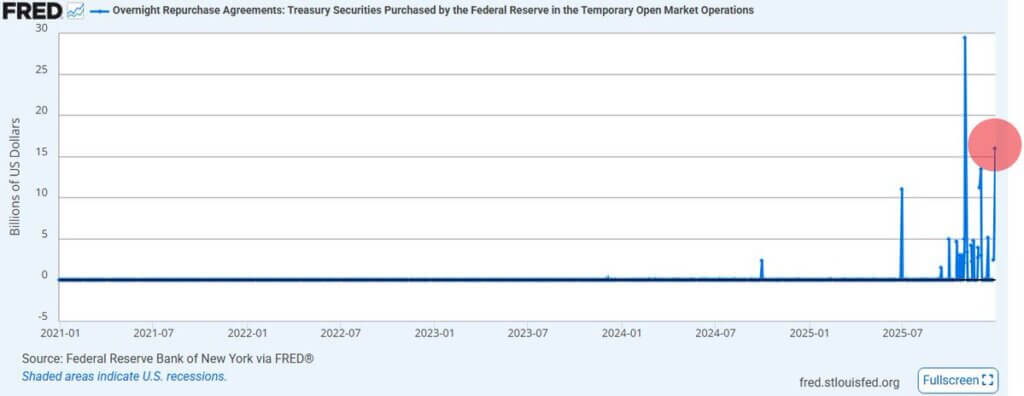

The Fed just leaked a bullish liquidity signal that suggests Bitcoin can front-run a 2026 recovery

On the last day of 2025, while most traders were half watching fireworks and half pretending they were not checking charts, the quietest corner of the financial system started making a lot of noise. Banks pulled a record amount of cash

Tether just bought 8,888 Bitcoin, exposing a mechanical profit engine turning T-Bills into automatic crypto demand

Tether bought 8,888 Bitcoin in Q4 2025, lifting its holdings above 96,000 BTC, according to a post by CEO Paolo Ardoino. The purchase extends a strategy Tether has tied to operating results: allocating 15% of quarterly profits to Bitcoin. If USDT liabilities

XRP on exchanges hits 8 year low, but historical data exposes a brutal flaw in the popular “moon” narrative

Glassnode data shows that XRP's exchange balances hit their lowest level since 2018 in late December, sparking the usual wave of accumulation phase speculation and “tight supply = moon” commentary. While the eight-year low encompasses the entire exchange ecosystem, CryptoQuant data

Bitcoin “died” four times in 2025, but a hidden infrastructure boom proves the skeptics completely wrong

2025 delivered at least four distinct “crypto is dead” episodes: a January AI-induced flash crash, the October tariff liquidation that erased $19 billion in leveraged positions, months of altcoin carnage, and a fourth quarter slump that wiped out the year's

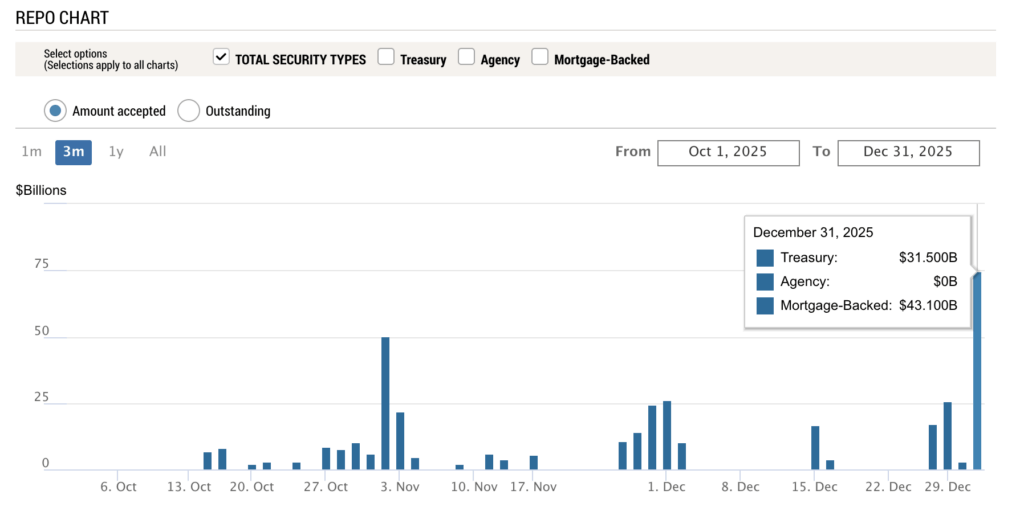

Shock $74B emergency bank loan on NYE just revived the dark “COVID cover-up” secret bailout theory

On the last trading days of the year, the kind of chart that almost nobody outside finance ever looks at started yelling again. Banks piled into the Fed’s Standing Repo Facility, borrowing a record $74.6 billion on Dec. 31 for 2025.

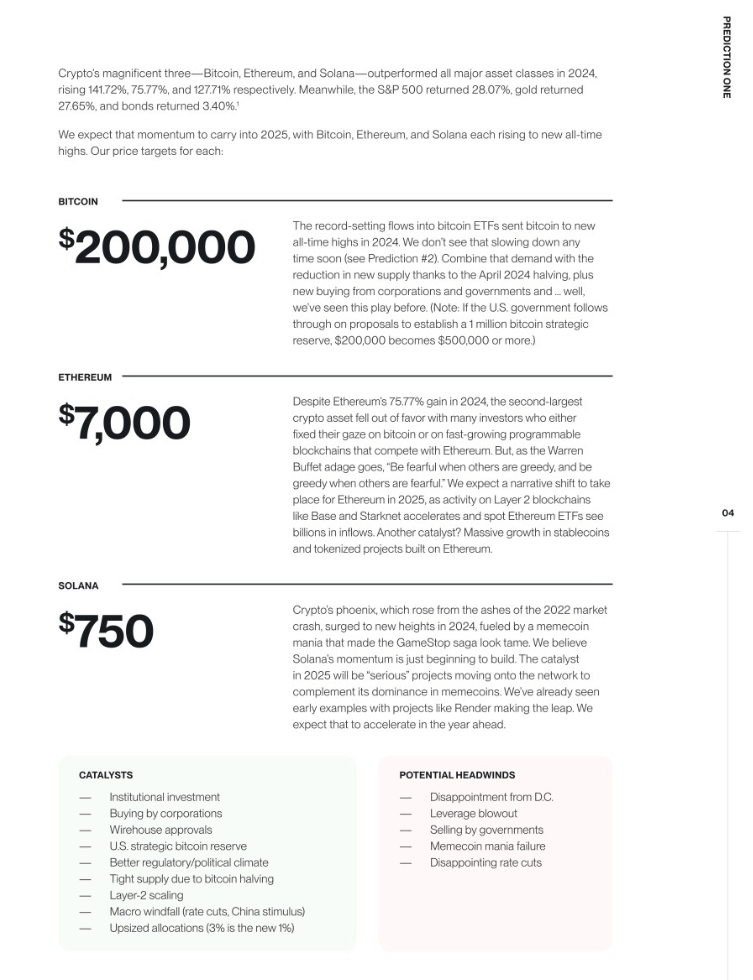

Which predictions landed this year? One ignored model actually nailed the 2025 market cycle

At the start of 2025, crypto's biggest names issued bold forecasts: Bitcoin to $200,000, Ethereum to $7,000, a US strategic reserve, and stablecoins going mainstream. Twelve months later, the scoreboard reveals a pattern. The price targets mostly crashed and burned, while

Bitwise just filed for 11 new crypto ETFs, and the market’s silence exposes a brutal new reality

Bitwise's year-end barrage of ETF paperwork should have been a perfect spark for “alt season.” On Dec. 30, the issuer filed with the US Securities and Exchange Commission to launch 11 single-token “strategy” ETFs tied to Aave, Uniswap, Zcash, NEAR,

Banks just demanded $26 billion in emergency cash but Bitcoin traders are missing a critical warning signal

It started the way these things often do: a screenshot, a red circle, a big number, and a timeline that makes your stomach do a tiny flip. On Dec. 29, the Federal Reserve’s overnight repo line item jumped to $16 billion

Crypto hacks dropped by half in 2025, but the data reveals a much deadlier financial threat

This year’s defining security event was not a sophisticated DeFi exploit or a novel protocol failure, but the $1.46 billion theft from Bybit, a top-tier centralized exchange. That single event, attributed to sophisticated state-sponsored actors, rewrote the narrative of the year.

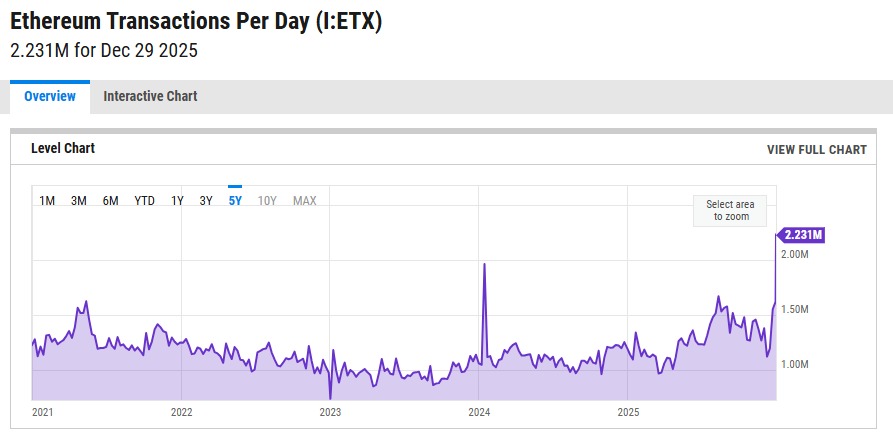

Ethereum lost over $100 million in fees this year, and one corporate giant kept the profit

The Ethereum blockchain recorded its strongest operational year in history in 2025, processing record transaction volumes and securing the vast majority of the DeFi market. However, the crypto asset that powers the network failed to mirror that growth, posting double-digit losses

How Strategy used half its stock price to buy 225,000 Bitcoin in 2025

In 2025, Strategy (formerly MicroStrategy) executed a capital markets feat that effectively cornered the supply of new Bitcoin, purchasing more coins than the global mining network produced for the entire year. Throughout the year, Strategy added approximately 225,027 BTC to its

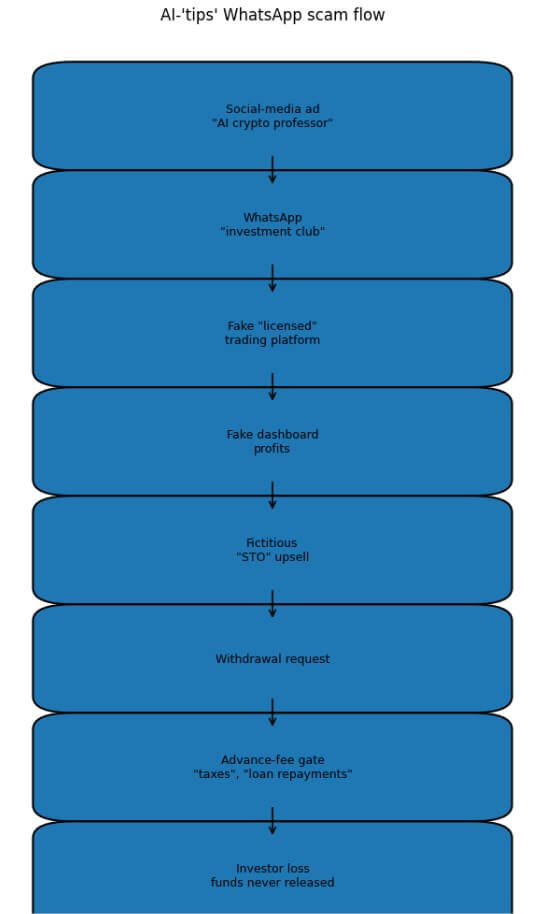

SEC filings reveal the multi-million dollar trap hiding inside ‘exclusive’ WhatsApp crypto investment clubs

Investors logged into glossy crypto trading dashboards showing five-figure “profits,” then found themselves blocked from withdrawing a cent unless they first wired extra “taxes” or “loan repayments” to overseas accounts. When victims tried to cash out, the platforms demanded advance fees

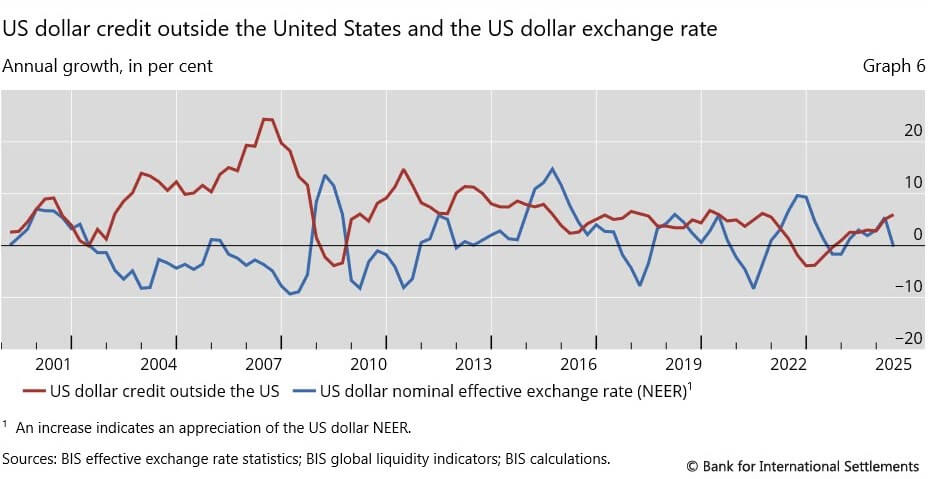

Bitcoin just lost a hidden $2 trillion liquidity safety net, leaving it exposed to a brutal new pressure wave

Bitcoin's 2025 rally sat on a liquidity foundation that looks solid until investors examine what changed in the final quarter. Some analysts point to global liquidity indexes hitting record highs and declare the wave is still building. Others cite CrossBorder Capital's

Bitcoin order books just exposed the “wild” mechanics secretly crushing every rally before it starts

Bitcoin has spent the past several weeks going nowhere fast, and that is not because traders have run out of opinions. It is because the market is quietly boxed in by wild forces most people never see. New Binance order-book pressure

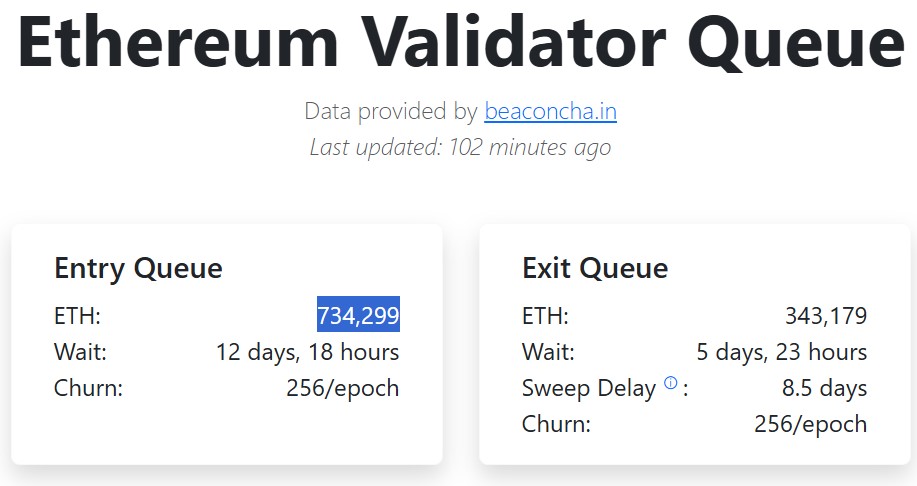

Ethereum’s record staking queue looks bullish, but one corporate giant is secretly distorting the real signal

A single corporate treasury has effectively hijacked Ethereum’s validator mechanics, executing a billion-dollar maneuver that has flipped the network’s flow data from a steady exodus to a sudden traffic jam. For the first time in six months, the queue to stake

Bitmain just slashed mining rig prices, proving the market’s oldest “Bitcoin rule” is officially dead

Bitmain cut prices on Bitcoin mining rigs on Dec. 23 after miner revenue per unit of hashrate fell in November. The discounts, which extend to current-generation hydro and immersion products, are landing in a cycle in which Bitcoin’s price strength has

Bitcoin just lost $90,000, and a quiet surge in energy markets suggests the pain isn’t over

Bitcoin traded near $86,800 on Monday morning after reversing its Sunday move above $90,000, as crude oil rose and gold fell.