The US government just caved to a crypto exchange pulling support for legislation that changes everything for investors

The US crypto industry believed it stood on the precipice of securing the regulatory legitimacy it has pursued for a decade, but the political ground has suddenly shifted beneath it. On Jan. 14, Sen. Tim Scott, the chair of the Senate

Crypto futures legitimized by CME with Cardano, Chainlink, and Stellar addition, but retail traders face a massive catch

The era of the crypto industry being seen as a two-asset town is officially over at the world’s largest derivatives marketplace. On Jan. 15, CME Group announced plans to launch futures contracts for Cardano (ADA), Chainlink (LINK), and Stellar (XLM) on

Ripple’s massive license victory hides a structural shift that could actually divert volume away from XRP

Ripple has secured a critical regulatory foothold in the European Union, marking the firm's second major licensing victory in less than a week. On Jan. 14, the crypto-focused payment company announced it received preliminary approval from Luxembourg’s regulator, the Commission de

Get access to Strategy’s 11% Bitcoin dividends without owning the stock through this new token

Crypto startup Saturn is raising funding for an on-chain dollar product, USDat, that routes yield from Strategy’s Bitcoin-linked credit instruments into DeFi. The round included $500,000 from YZi Labs and a $300,000 angel raise led by Sora Ventures, as Saturn positions

Bitcoin demand is breaking out, but dealers are mechanically forcing stability: Here is the exact price the dam cracks

Bitcoin is now trading around near $96,000 as spot ETF inflows and options market positioning exert opposing mechanical forces on price behavior. The current price sits just outside a range between roughly $90,000 and $94,000, a band that has persisted despite

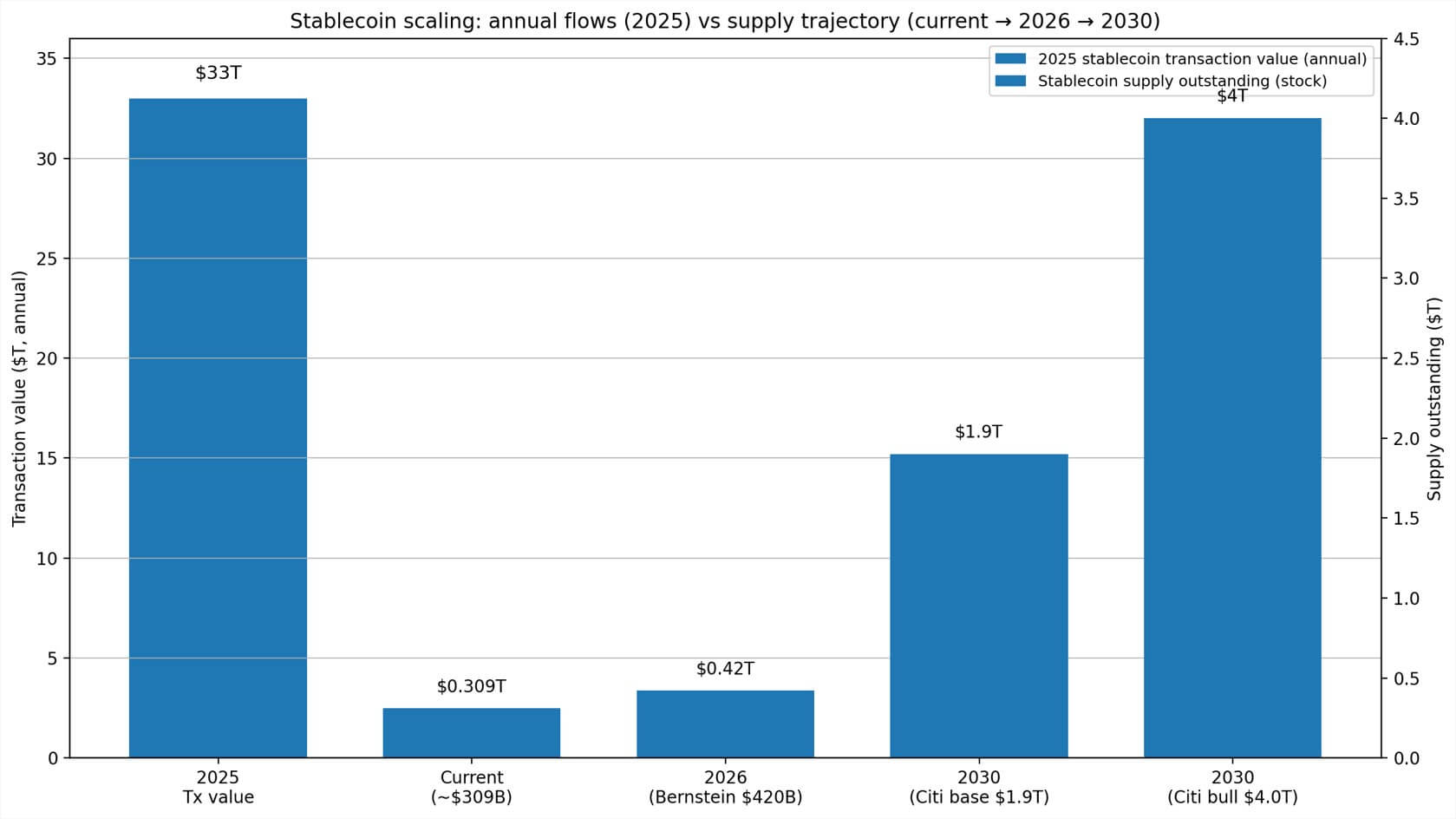

SEC Chair predicts 2-year timeline to put US fully on chain but the real $12.6 trillion opportunity isn’t equities

SEC Chair Paul Atkins told Fox Business in December that he expects US financial markets to move on-chain “in a couple of years.” The statement landed somewhere between prophecy and policy directive, especially coming from the architect of “Project Crypto,”

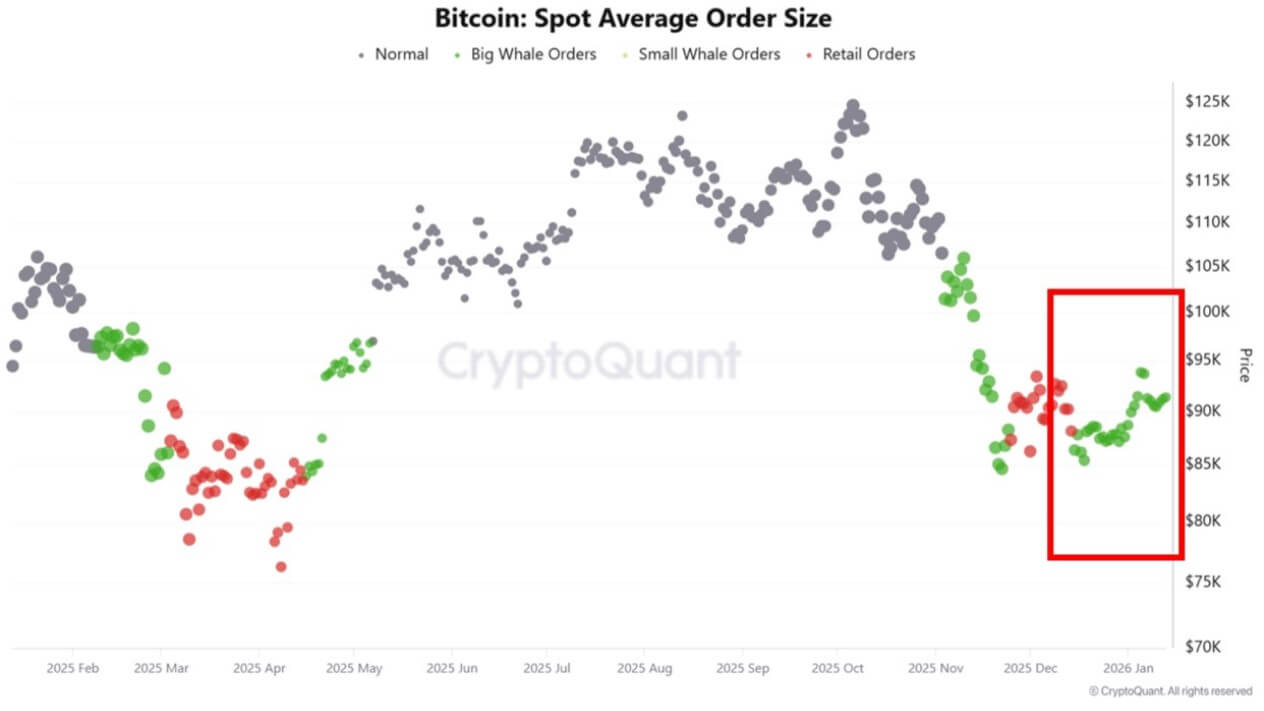

Why Wall Street refuses to sell Bitcoin – and actually bought way more – even while losing 25% of its value

Institutional investment managers increased their allocations to US spot Bitcoin exchange-traded funds (ETFs) during the fourth quarter of 2025, despite the asset suffering a sharp price correction that shaved nearly a quarter off its market value. The divergence between rising share counts

Bitcoin is following a discreet lag pattern behind gold that puts a $130k target immediately in play

Gold and silver pushed to fresh all-time highs this week, creating a financial gap that sets the stage for a potential Bitcoin catch-up rally. According to Gold Price data, gold reached an all-time high of over $4,600, with industry experts predicting

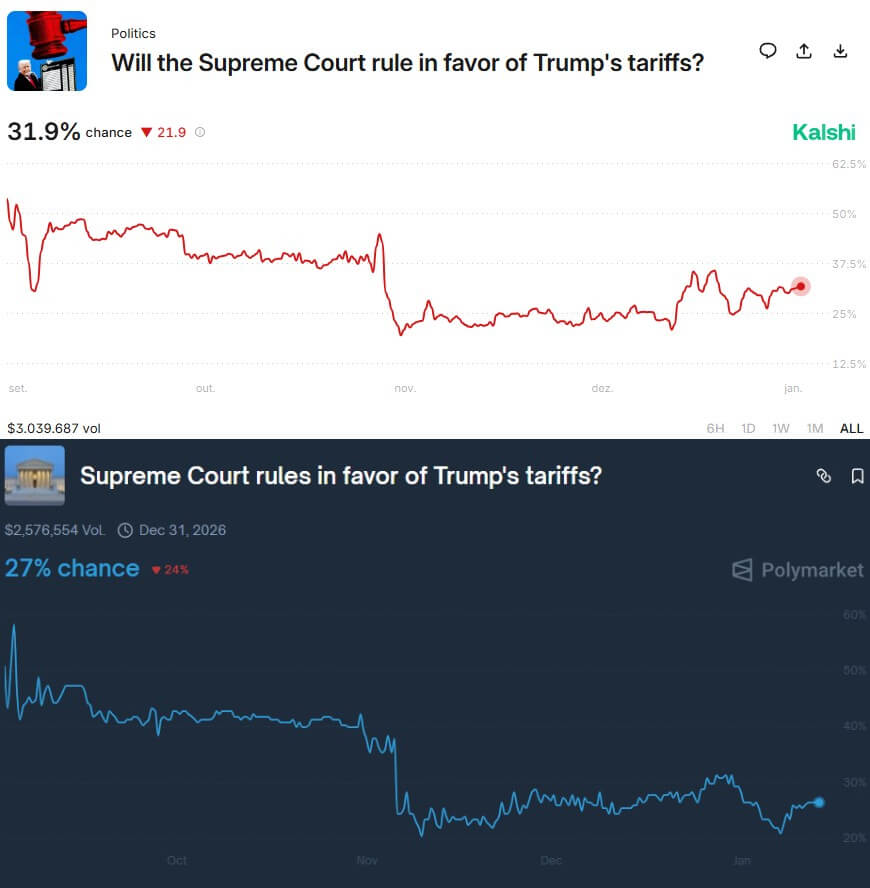

Bitcoin ignored Trump’s latest 25% tariff threat, but the $19B liquidation ghost from October is quietly resetting in the shadows

President Donald Trump declared on Jan. 12 that the US would impose a 25% tariff on any country conducting business with Iran, “effective immediately,” via Truth Social. Bitcoin (BTC) dipped briefly below $91,000, then recovered above $92,000 within hours. No liquidation

Data reveals the new “sweet spot” for crypto in your portfolio as financial advisors flip aggressive on Bitcoin

Financial advisors held crypto allocations below 1% for years, treating Bitcoin as a speculative footnote rather than a portfolio component. That era is ending. According to Bitwise and VettaFi's 2026 benchmark survey, 47% of advisor portfolios with crypto exposure now allocate

Crypto yields expose the exact amount banks are underpaying you, and why they want Congress to ban it

While Congress pushes ahead with the CLARITY Act, the unfinished fight over how the U.S. draws the line between “crypto” and “securities” is spilling into public view, and into a familiar blame game. Online, critics argue the bill’s structure could hardwire

Bitcoin just wiped out $600 million in bets, triggering a “mechanical” loop that forces prices toward $100k

Bitcoin’s price rallied above $95,000 during the last 24 hours, signalling a definitive shift in market structure rather than a simple volatility spike. According to CryptoSlate's data, the top crypto rose by more than 3% to reach a high of over

Bitcoin is walking into a perfect setup for a long-term bull run but first faces a brutal 72-hour gauntlet

Bitcoin investors are bracing for a rare convergence of market forces this week, walking into a gauntlet of three distinct macro and policy catalysts packed into a single 72-hour window. The catalysts include the release of December’s Consumer Price Index (CPI)

The US Senate could wipe out $6 billion in crypto rewards this week by closing one specific loophole

The GENIUS Act banned issuer-paid yield, but the Senate markup fight is whether exchanges can keep routing rewards around that restriction, and the answer could decide who controls $6 billion in annual incentives. Senate Banking is scheduled to consider the CLARITY

Energy grid operators are ignoring Bitcoin’s stabilization benefits to chase a wealthier, less flexible buyer

Former Binance CEO, Changpeng Zhao (CZ), recently stated that the UAE generates surplus power in order to cover “three days” of high demand each year, making Bitcoin a buyer of last resort for energy that would otherwise go unused. Stripping away

Here’s how the US government now offers a path to a new all-time high for Bitcoin and crypto CLARITY

On Jan. 13, the US Senate Banking Committee released the full text of the highly anticipated Digital Asset Market Clarity Act (CLARITY) ahead of its expected markup this week. The 278-page draft abandons the strategy of picking winners on a token-by-token

Bitcoin traders are bracing for a Fed “credibility shock” that hinges on one critical date this month

Bitcoin opened the year trading like it usually does when macro uncertainty rises: it moved with the tide of rates, the dollar, and risk appetite, even as investors tried to pin a more specific narrative on top. However, this week the

Two major crypto events canceled after city hit by 18 violent physical attacks on crypto holders amid market downturn

NFT Paris was supposed to be the kind of week people plan their year around. You book the ticket, you text the group chat, you lock in the flights before prices jump, you tell yourself the hotel bill is “work”, you