Analog January has people worldwide quietly moving offline, and the biggest Bitcoin risk isn’t price volatility

Analog January is meeting Bitcoin at the custody layer as some investors seek exposure without screen time. The digital-minimalism push, framed as “tech-low and slow living,” is landing as crypto returns to a volatility regime that makes constant checking expensive. Analog January

Bitcoin just failed its biggest ‘digital gold’ test, and the reason why should have every investor deeply worried

Bitcoin price succumbed to a violent selloff on Monday while gold and silver surged to all-time highs following President Donald Trump‘s threat of sweeping new tariffs on European allies. According to CryptoSlate's data, BTC slipped below $93,000 within minutes during early

Why Bitcoin investors should worry about a 17% fertilizer surge that threatens to blow up the cooling inflation narrative

Bitcoin investors may be watching CPI prints, but the real inflation stress is showing up in stranger places. Inflation looks like it’s easing, until you zoom in. Beef prices are up sharply, fertilizer costs are reaccelerating, and several niche input series

Trump just broke from his tariff threat playbook for the first time causing Bitcoin to miss Sunday night relief rally

On Monday morning, the market did that thing it always does when politics stops being background noise and starts grabbing the steering wheel. Screens went red, chats filled with the same half-jokes about “macro,” and Bitcoin slipped back under the psychological

Bitcoin faces a massive liquidity shift as these five crypto gatekeepers prepare to tighten the remaining market chokepoints

Bitcoin pricing in 2026 may hinge on officials and executives who set dollar liquidity, US market access, ETF distribution, stablecoin settlement capacity, and exchange venue rules, based on a market-structure framework that prioritizes chokepoints over social reach. The scale of each

Bitcoin could be your only liferaft as Bank of England experts brace for alien disclosure chaos

Bitcoin could emerge as a long-term winner if global authorities confirm the existence of non-human intelligence, even if the immediate fallout triggers a severe financial shock. Over the weekend, reports emerged that Helen McCaw, a former senior analyst at the Bank

How crypto is being devoured by TradFi, killing Satoshi’s dream by rewarding centralization

Bitcoin’s price, and thus the entire crypto market, is increasingly being anchored by flows through regulated wrappers. Crypto is increasingly being subsumed by TradFi rather than offering an alternative to the broken system Satoshi criticized. U.S. spot ETF subscriptions and redemptions

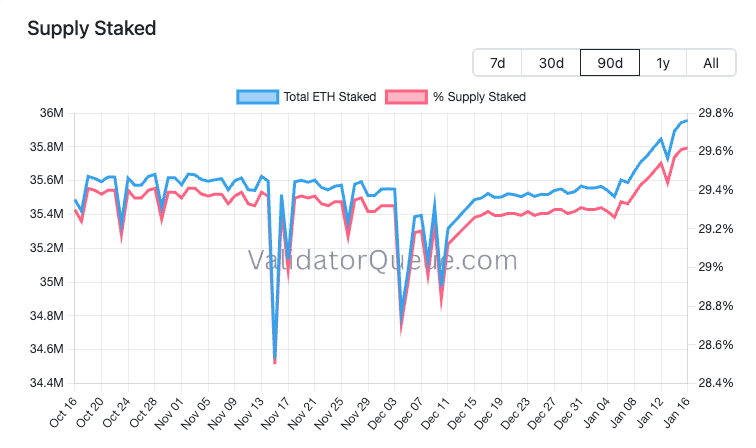

Ethereum staking just hit a $118B record at 30% of all coins, but one whale might be skewing the signal

More than 36 million ETH is now staked in Ethereum's proof-of-stake system, close to 30% of the circulating supply and worth over $118 billion at recent prices. Graph showing the amount of ETH staked in the Ethereum network from Oct. 16,

Bitcoin is the only “escape valve” left as the ECB warns a political tussle will soon destabilize the dollar

European Central Bank chief economist Philip Lane delivered a warning that most markets treated as European housekeeping: the ECB can stay on its easing path for now, but a Federal Reserve “tussle” over mandate independence could destabilize global markets through

Bitcoin is lagging while metals soar, but this rare divergence preceded every major crypto breakout since 2019

Gold and copper have moved higher even as the Federal Reserve continues to signal patience on rate cuts, a divergence that shows how markets tend to price liquidity conditions ahead of formal policy shifts rather than wait for confirmation from

Ethereum may finally kill “trust me” wallets in 2026, and Vitalik says the fix is already shipping

Vitalik Buterin framed 2026 as the year Ethereum reverses a decade of convenience-first compromises. His thesis: the protocol stayed trustless, but the defaults drifted. Wallets outsourced verification to centralized RPCs. Decentralized applications became server-dependent behemoths that leak user data to dozens

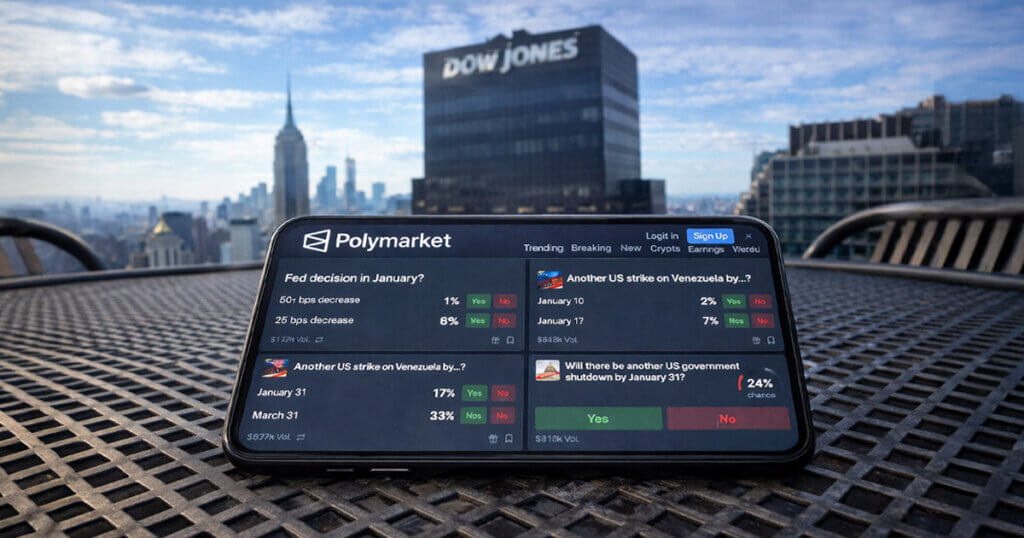

Kalshi and Polymarket face a “sports gambling” probe that could void your trades and shut down the market

On Jan. 9, Tennessee’s sports betting regulator sent a set of letters that, at first glance, looked like the kind of paperwork most crypto natives scroll past. The message was blunt: stop offering sports-related event contracts to Tennessee residents, void unsettled

XRP volume is exploding in Korea because it exploits a specific gap in the country’s spot-only exchange laws

XRP has become the default trading chip of South Korea, bypassing Bitcoin and Ethereum to dominate the country’s high-velocity retail market. While institutional capital worldwide typically gravitates toward Bitcoin as a store of value, South Korean trading patterns tell a different

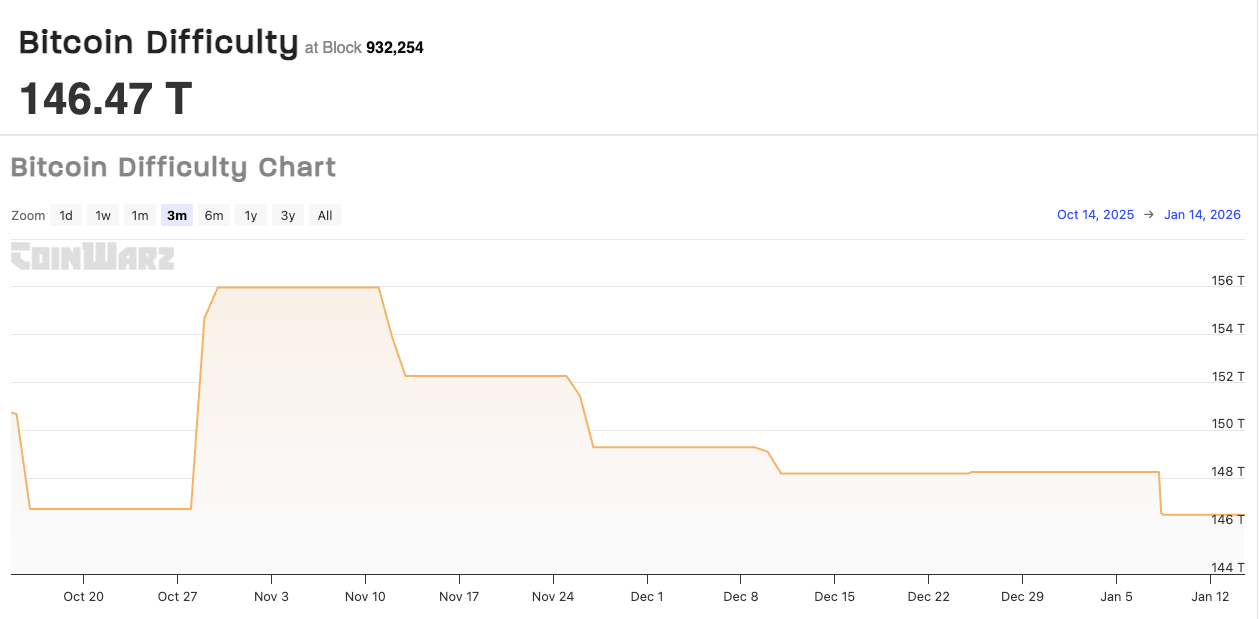

Bitcoin difficulty just retreated, but a more critical “survival metric” signals the mining sector is bleeding out

Bitcoin’s first difficulty adjustment of 2026 was anything but dramatic. The network nudged the dial down to about 146.4 trillion, a pretty small retreat after the late-2025 grind higher. Graph showing Bitcoin's mining difficulty from Oct. 14, 2025, to Jan. 14,

Why writing open-source code is suddenly an existential risk, and the five-page bill designed to fix it

Two senators have introduced a short bill with an unusually big ambition: to stop US law from treating people who write and publish blockchain software as if they were running a shadow payments company. The proposal, titled the Blockchain Regulatory Certainty

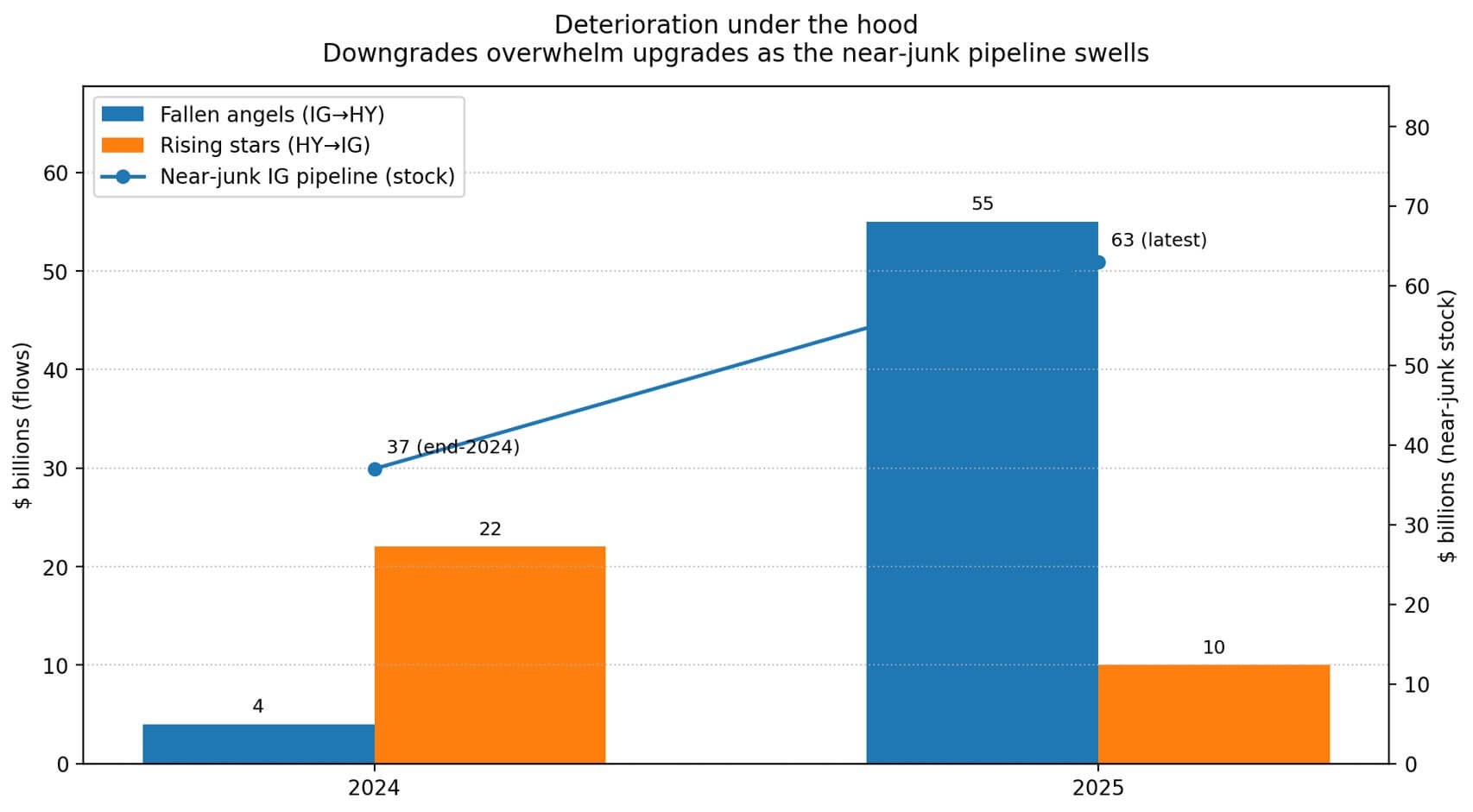

Bitcoin’s next major move hinges on a $63 billion “fallen angel” signal that most investors are completely ignoring

Corporate credit quality is deteriorating beneath a surface that looks deceptively calm. JPMorgan tallied roughly $55 billion in US corporate bonds that slid from investment-grade to junk status in 2025, the so-called “fallen angels.” At the same time, only $10 billion

Why a record 13M crypto projects are now dead as Bitcoin critics still claim “anyone can launch a token”

Bitcoin developer, Jameson Lopp, posted a simple observation days after CoinGecko published its 2025 dead coins report. Ignorant folks claim that Bitcoin isn't scarce because anyone can launch their

Bitcoin’s “quantum” death sentence is causing a Wall Street rift, but the fix is already hidden in the code

The consensus that Bitcoin has matured into “digital gold” faces a new fracture line on Wall Street, one that has little to do with daily price volatility and everything to do with the distant future of computing. Two prominent strategists named