New $150 million CFTC war chest to end withdrawal delays and weaponize complaints against failing crypto exchanges

Senate Agriculture Committee Chair John Boozman on Jan. 21 released updated text for a crypto market structure bill and set a committee markup for Jan. 27. The draft bill, titled the “Digital Commodity Intermediaries Act,” would give the Commodity Futures Trading

Crypto’s $50 billion lie masks a brutal reality where massive mergers are quietly killing off every new experiment

The crypto industry's capital headline for 2025 looks like a comeback story: $50.6 billion across 1,409 transactions, up sharply from 2024's totals. However, the composition tells a different story. According to the annual Crypto Fundraising Report, 43.7% of that capital came from

Bitcoin regret is coming for anyone ignoring Coinbase CEO’s 5% rule as banks fight to cap gains

Coinbase CEO Brian Armstrong told Bloomberg at Davos that investors who don't have at least 5% of their net worth in Bitcoin will “probably be pretty sad” by 2030. Recently, Morgan Stanley's wealth management division published portfolio guidelines capping crypto exposure

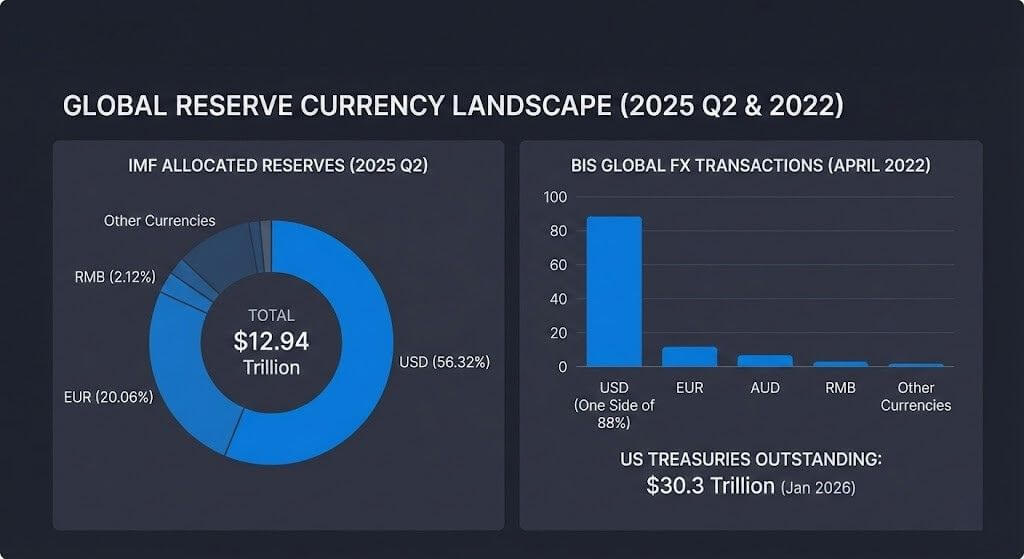

The dollar stays king until 2046 crushing Bitcoin dreams with $13 trillion of IMF data

Bitcoin’s earliest realistic path to becoming the world’s global reserve currency (defined here as reserve-currency primacy rather than limited reserve-asset adoption) sits around the mid-2040s under a scenario model that treats official mandates, collateral usage, and invoicing conventions as binding

Exposing a dirty secret: What uses more power, Bitcoin, streaming, AI, or social media?

Bitcoin mining consumed around 171 TWh in 2025, representing 16% of total data center energy use. All traditional data centers worldwide consumed between 448 and 1,050 TWh in 2025, with estimates varying across analysts' data. Gartner has it at 448 TWh,

Bitcoin prices are recovering as gold retreats because a surprise “framework deal” just killed the tariff threat

President Donald Trump's announcement that he would not impose tariffs scheduled for Feb. 1 triggered a sharp reversal in risk assets, with Bitcoin rebounding above $90,000 after testing $87,300 earlier in the session. The move erased most of a two-day selloff

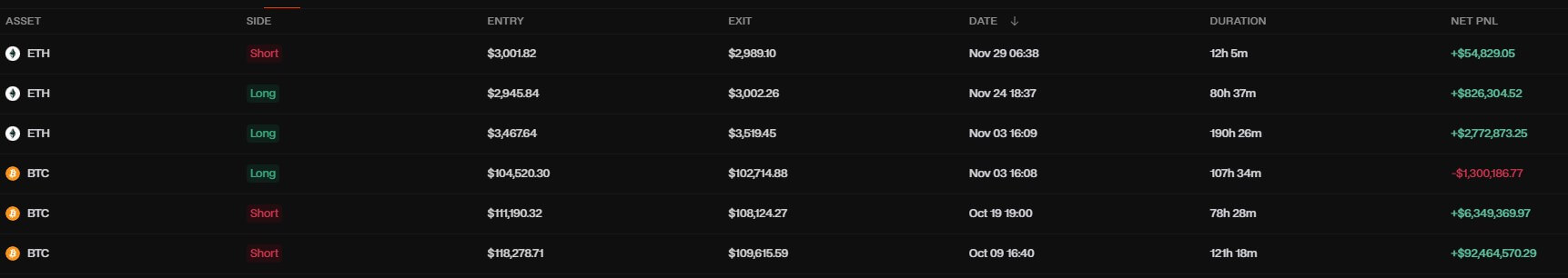

The “insider wallet” that made over $100M on October tariff trade in threat of liquidation if one asset continues to dip

A single wallet on Hyperliquid holds a long position worth roughly $649.6 million in Ethereum (ETH), with 223,340 ETH entered at around $3,161.85, with a liquidation estimate near $2,268.37. As of press time, ETH traded around $2,908.30, and the liquidation threshold

Bitcoin hits Federal Reserve’s 2026 stress tests, creating a massive capital risk for banks

Pierre Rochard's call for the Federal Reserve to integrate Bitcoin into its stress tests came at an unusual moment: the Fed is soliciting public comment on its 2026 scenarios while simultaneously proposing new transparency requirements for how it builds and

Over $1B in Bitcoin liquidity evaporated as the Wall Street feedback loop looks to wipe out gains

U.S. spot Bitcoin exchange-traded funds recorded three straight trading sessions of net outflows this week, totaling $1.58 billion. The pullback follows a brief stretch of positive follow-through, sandwiched between another three-day outflow streak from Jan. 7 – 9 that totaled $1.134

BlackRock backs Ethereum gatekeeping tokenization even though its market share is under threat

BlackRock’s 2026 Thematic Outlook put Ethereum at the center of its tokenization thesis, asking whether the network could serve as a “toll road.” BlackRock stated that “of tokenized assets 65%+ are on Ethereum.” The framing pushes Ethereum into an infrastructure role rather

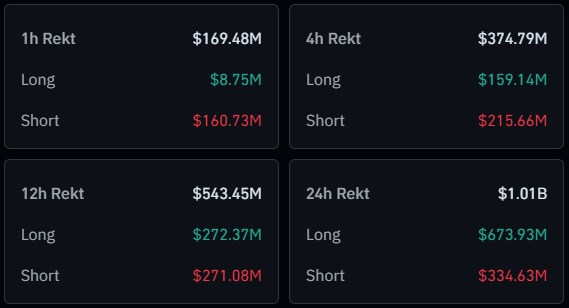

Bitcoin just erased all 2026 gains as a $1.5 billion liquidation trap catches every trader off guard

Bitcoin price surrendered the psychological $90,000 stronghold during early Asian trading hours on Jan. 21, marking a decisive breakdown that has effectively erased the asset's gains for the start of 2026. According to CryptoSlate's data, the world’s largest digital asset plummeted

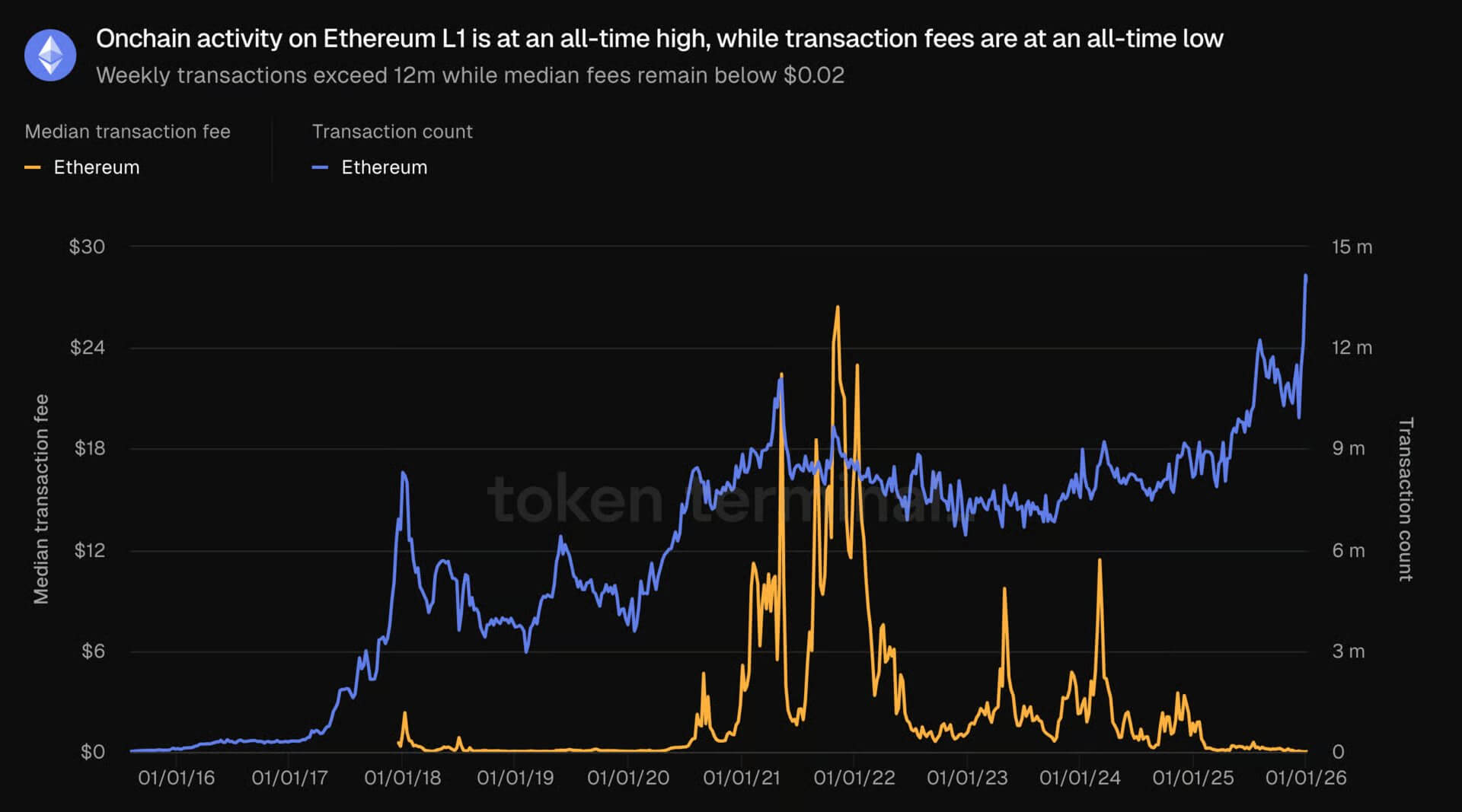

How an industrial-scale scam is driving Ethereum transactions to record highs because of cheap gas fees

Ethereum is currently reporting the highest daily network growth in its history, a statistical surge that ostensibly signals a massive return of user activity. Over the past week, the Ethereum mainnet processed 2.9 million transactions, a new all-time high according to

Bitcoin is now your only lifeboat as Canada says the current world order is merely a “pleasant fiction”

Canada's Prime Minister, Mark Carney, walked onto the World Economic Forum's Davos stage yesterday and said the quiet part out loud. The rules-based order, the thing leaders love to invoke when they want the world to behave, is fading. Carney called it

Bitcoin is in the blast radius after Japan’s bond market hit a terrifying 30-year breaking point

At first glance, this looks like a story that lives on the back pages of a newspaper, Japanese government bonds with maturities that run so long they sound like a joke, 20 years, 30 years, 40 years. If you own Bitcoin,

Ripple’s RLUSD just got Binance’s strongest growth lever, can that catapult it into a top 3 asset?

Binance, the largest crypto exchange by trading volume, has listed Ripple's RLUSD stablecoin on its platform. On Jan. 21, the exchange announced that it would open spot trading pairs, including RLUSD/USDT, RLUSD/U, and XRP/RLUSD, on Jan. 22 by 8 AM UTC. Critically,

Why Metaplanet is the only Bitcoin treasury surviving a brutal market shift that left Strategy investors totally exposed

Vanguard increased its position in Metaplanet from 14.12 million shares at the end of November to 15.64 million shares by Dec. 31, an 11% jump that sent speculation rippling through Bitcoin (BTC) treasury circles. The move arrived at a moment when

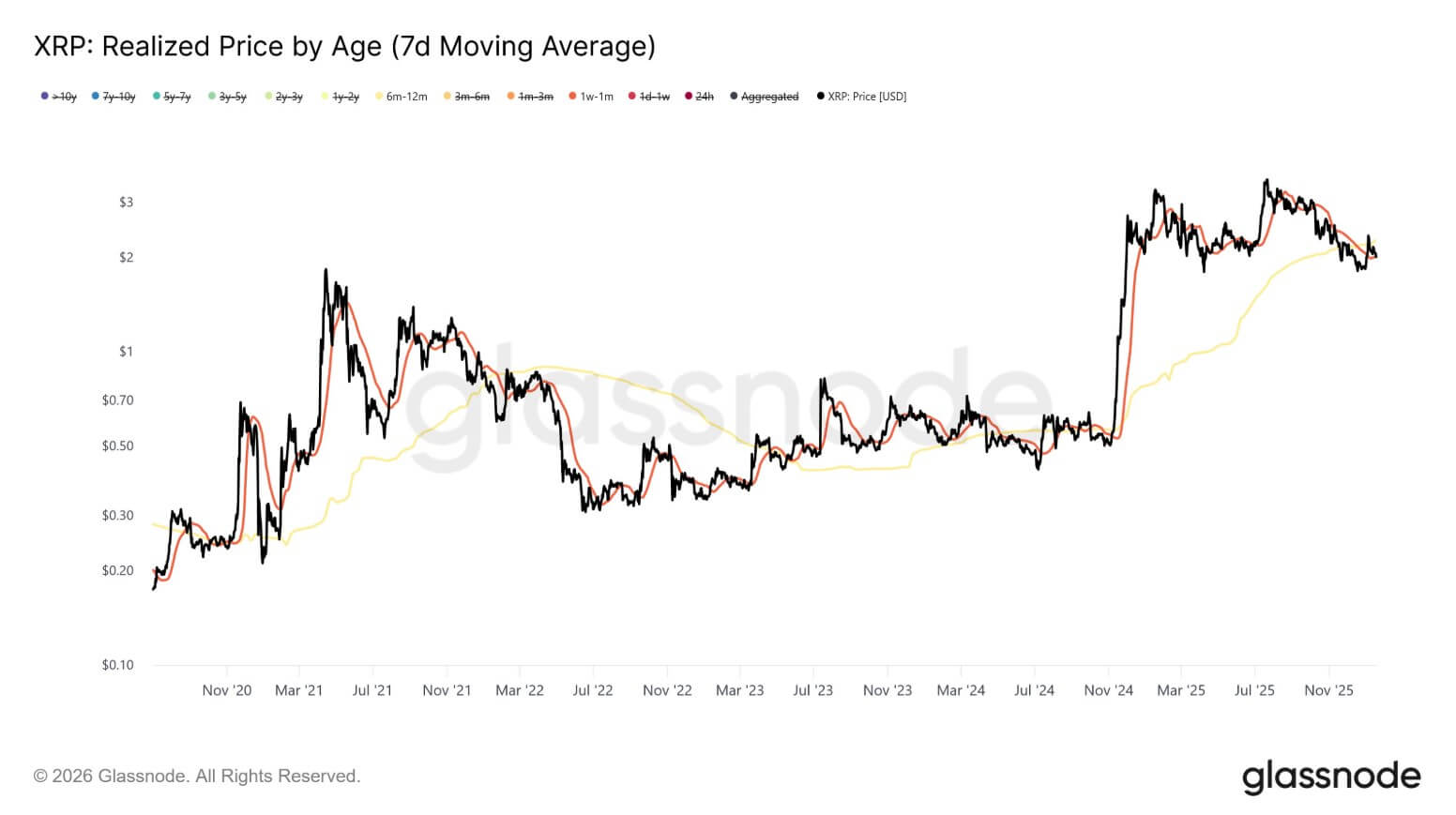

While 71% are in profit XRP just triggered a rare signal last seen in 2022 that could paralyze rallies for months

XRP's on-chain structure now mirrors a precarious moment from early 2022, when short-term accumulation beneath longer-term cost bases set the stage for prolonged sideways chop. Glassnode flagged the pattern on Jan. 19: investors active over the 1-week to 1-month window are

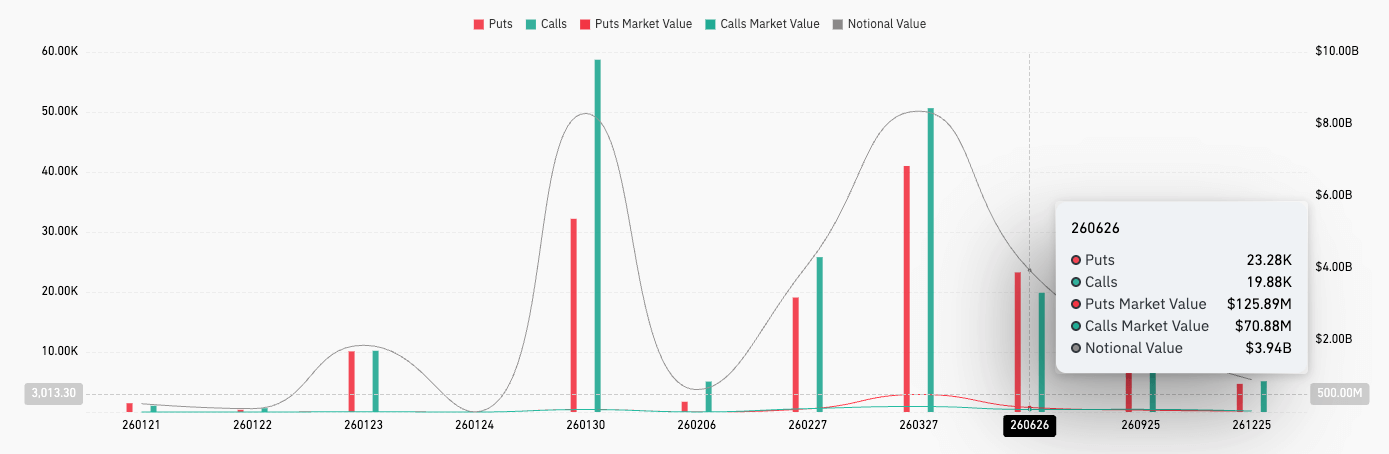

Bitcoin traders are dumping billions into insurance in case the price drops to $75k as June options expiry creates a high-stakes price trap

Bitcoin’s June 26 options expiry provides a clean snapshot of how risk is being framed several months out, and the picture that emerges is one of deliberate insurance. Total open interest for the expiry sits near $3.92 billion in notional terms