Washington could still derail XRP’s $173B comeback in its breakout year

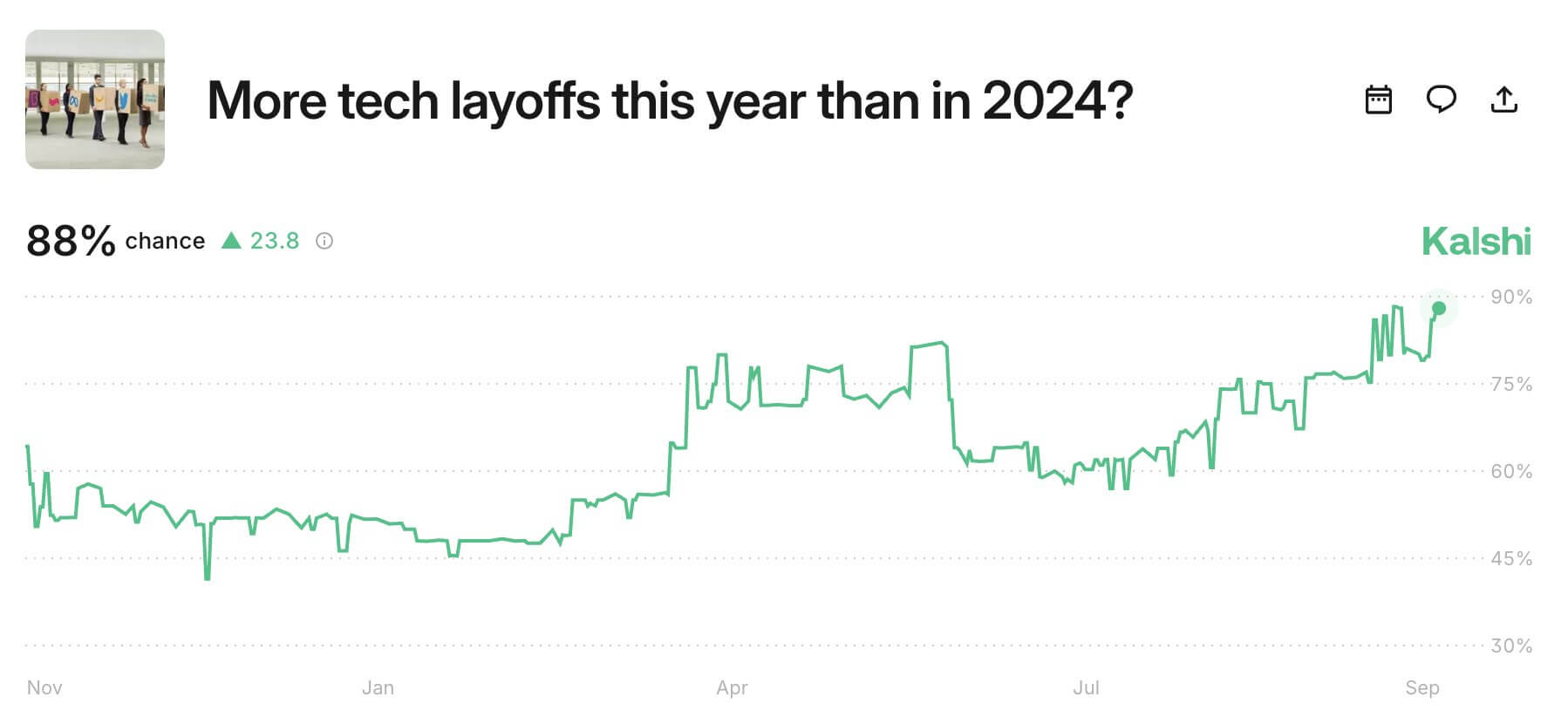

The probability of a US government shutdown has climbed to levels not seen in years, with prediction market Kalshi pricing a 73% chance that lawmakers fail to pass a funding bill before the Oct. 1 fiscal deadline. The sharp increase reflects

Strategy expands Bitcoin holdings to record 649,031 BTC despite MSTR stock slump

Strategy (formerly MicroStrategy) expanded its Bitcoin holdings by purchasing of 196 BTC for $22.1 million at an average price of $113,048 per coin, according to a filing with the US Securities and Exchange Commission (SEC) dated Sept. 29. According to the

The clock is running out on Bitcoin’s $200k dreams in 2025

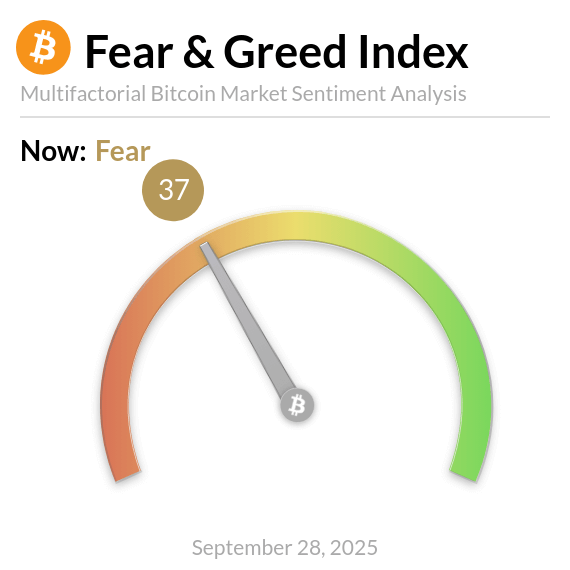

With fewer than 100 days left in 2025, Bitcoin is trading at just over $109,000, roughly 12% below its August all-time high. A growing chorus of analysts and investors is starting to question whether the ambitious $200,000 BTC price targets

Is the AI boom a house of cards? Deutsche Bank warns of unsustainable spending

The AI gold rush may be keeping the U.S. economy afloat, but according to Deutsche Bank, its current trajectory looks anything but sustainable. A new research note from the German lender warns that AI capital expenditures have reached such extraordinary heights

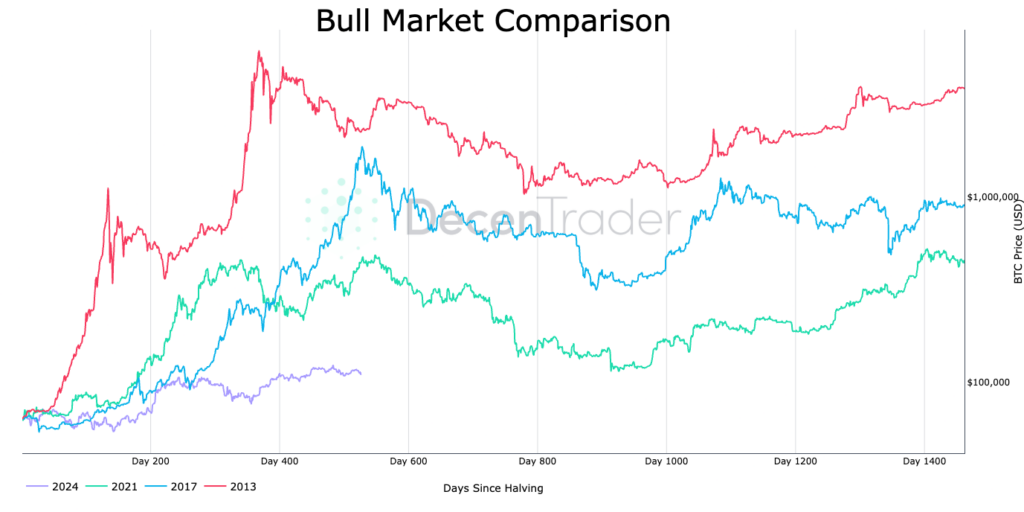

Bitcoin’s 2025 cycle dip mirrors 2017 – could $200k be next?

Bitcoin’s spot price movement throughout the third quarter of 2025 and its recent dip align closely with the cycle structure seen in 2017. Throughout the summer, Bitcoin oscillated in a consolidation range between $100,000 and $115,000, forming a technical base at

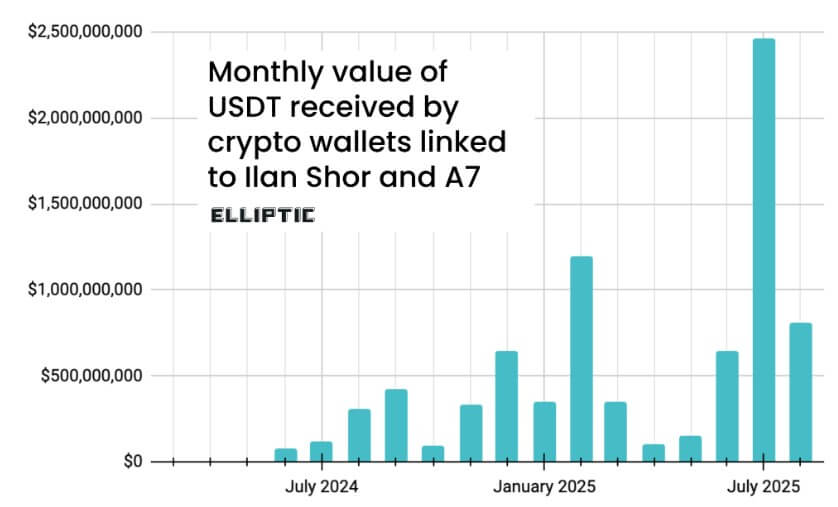

Russian-linked crypto wallets channel $8B to skirt sanctions using Tether’s USDT

A network of crypto wallets connected to Russian state-linked entities helped move more than $8 billion in digital assets to bypass Western sanctions, according to a Sept. 26 report from blockchain analytics firm Elliptic. The findings draw from a trove of

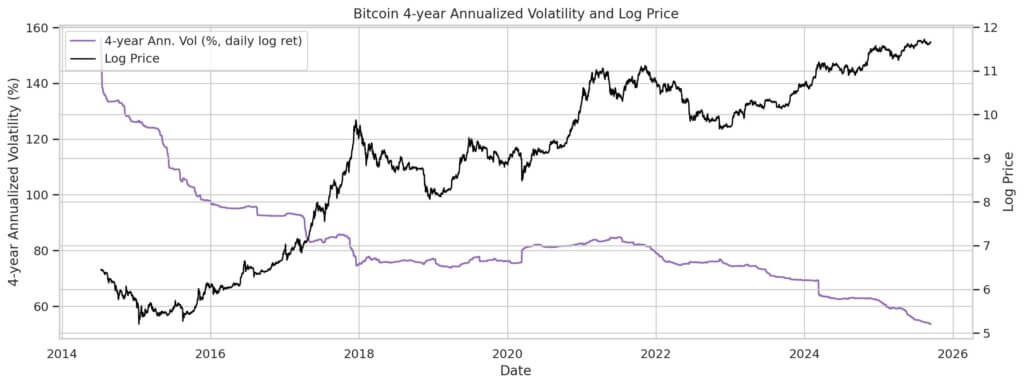

New evidence reveals Bitcoin’s ‘too volatile’ label doesn’t fit anymore

Bitcoin volatility has stayed below 50% on 60-day measures since early 2023, extending through 2025. According to Kaiko, the drawdown in realized volatility has persisted even as liquidity conditions and market participation changed, placing the asset in its longest low-vol regime

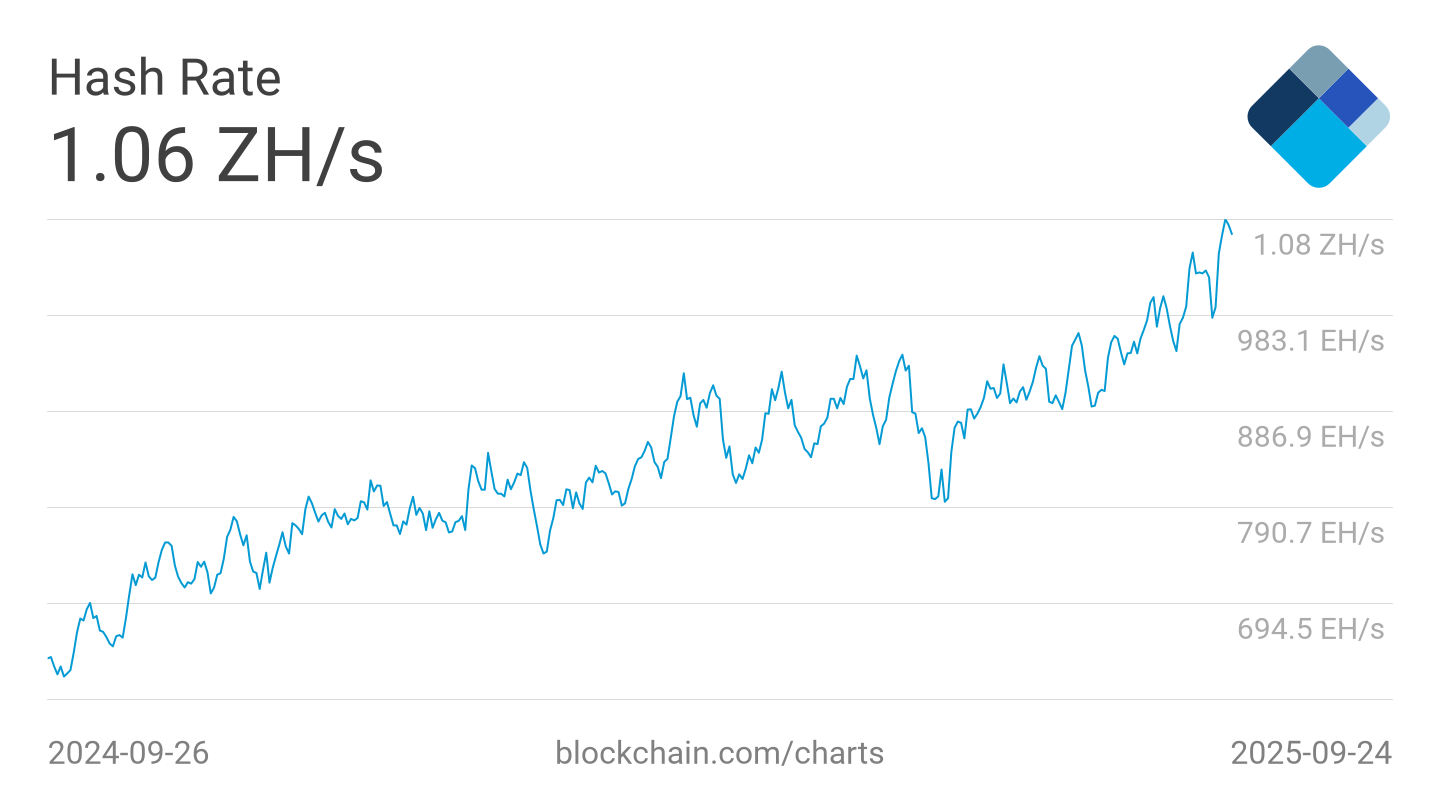

Why Bitcoin’s hashrate explosion could squeeze public miners next

On Sep. 23, Bitcoin’s hashrate set a new all-time high of 1,073 EH/s. Over the last month, raw compute rose about 21%. Over the last quarter, roughly 70%. Over the last year, the curve went vertical, up around 675%. Hashrate used to

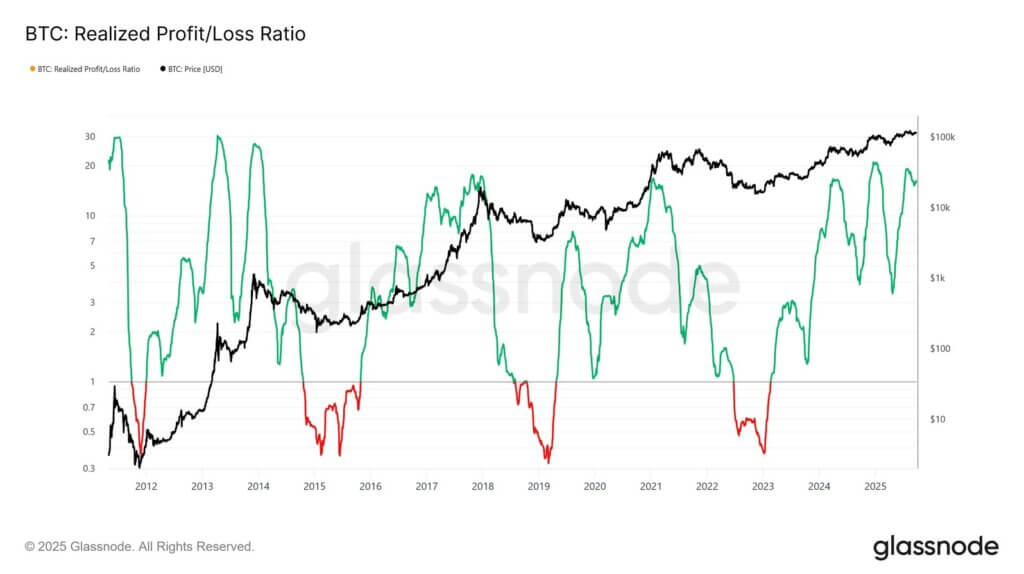

Bitcoin faces critical test as on-chain data reveals market exhaustion

Bitcoin’s (BTC) on-chain data reveals structural concerns about the sustainability of the current rally, and defending the $111,000 zone is fundamental to avoid further downside. As Glassnode reported on Sept. 25, the retreat from near $117,000 following the Federal Reserve’s rate

The dollar dying doesn’t make Bitcoin win

The rapid decline of the U.S. dollar has reignited dreams of “hyperbitcoinization” among Bitcoin proponents. But there is little evidence that the dollar dying means Bitcoin’s victory; and plenty that points toward widespread chaos instead. The dollar dying: lessons from currency

According to Adam Livingston, you have 5 years to stack Bitcoin before AI takes your soul

Are you paying attention? If Adam Livingston, author of The Bitcoin Age and The Great Harvest, is right, the most urgent countdown of your life is already underway. According to Livingston, AI isn’t just another in a long line of

Bitcoin’s next major move post-FOMC relies on staying above $115,200

Bitcoin (BTC) remains in a delicate balance following the Federal Reserve’s rate cut decision, where holding $115,200 is key to defining the next movement. Glassnode reported on Sept. 18 that derivatives markets and on-chain data revealed a market poised for its

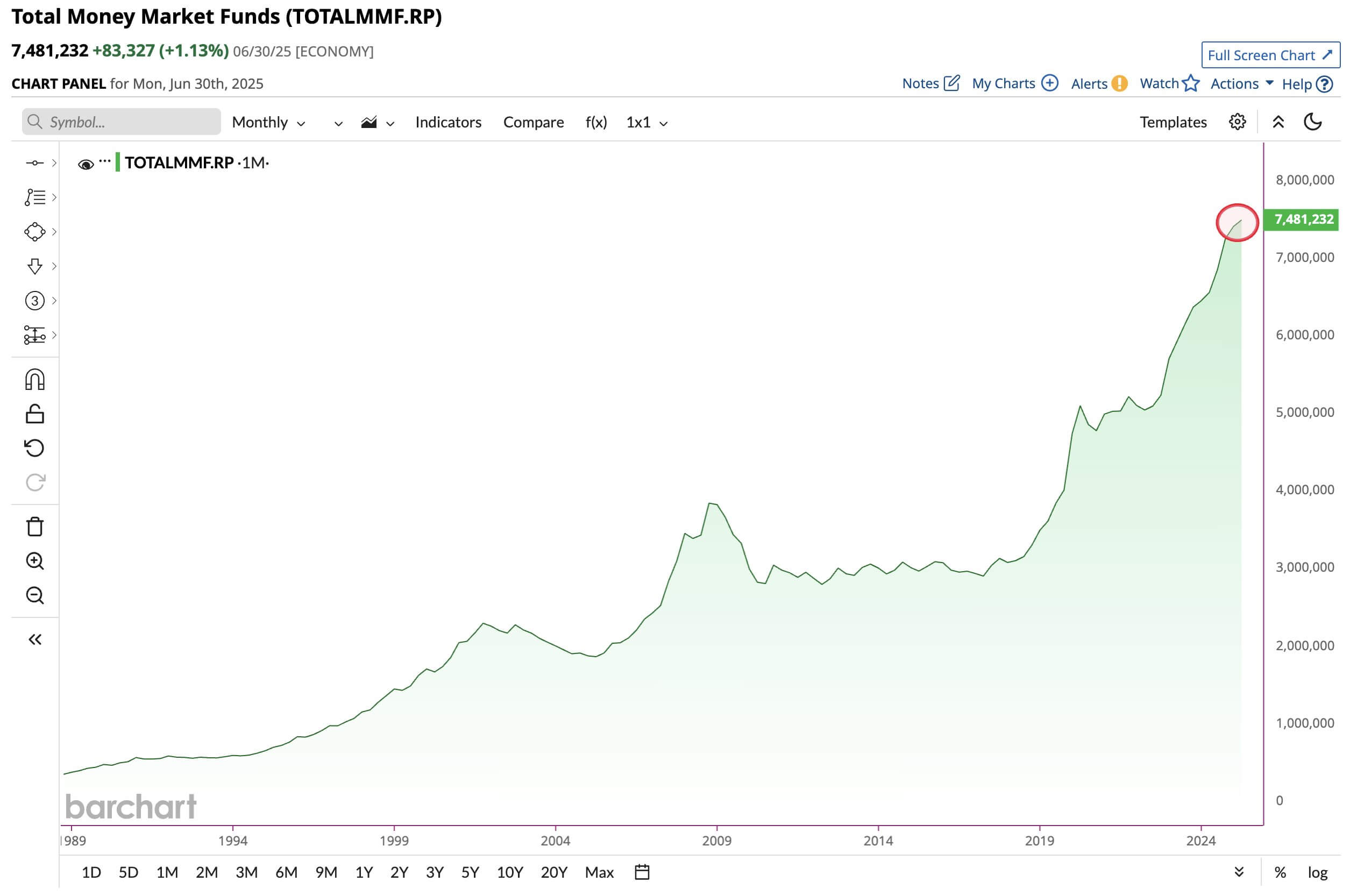

$7.5T in US money market funds could soon be seeking a new home

$7.5 trillion is now parked in U.S. money market funds. This vast amount of capital marks a new all-time high that risk asset traders are closely watching. Why? Because as yields trend lower and the Fed prepares to cut rates,

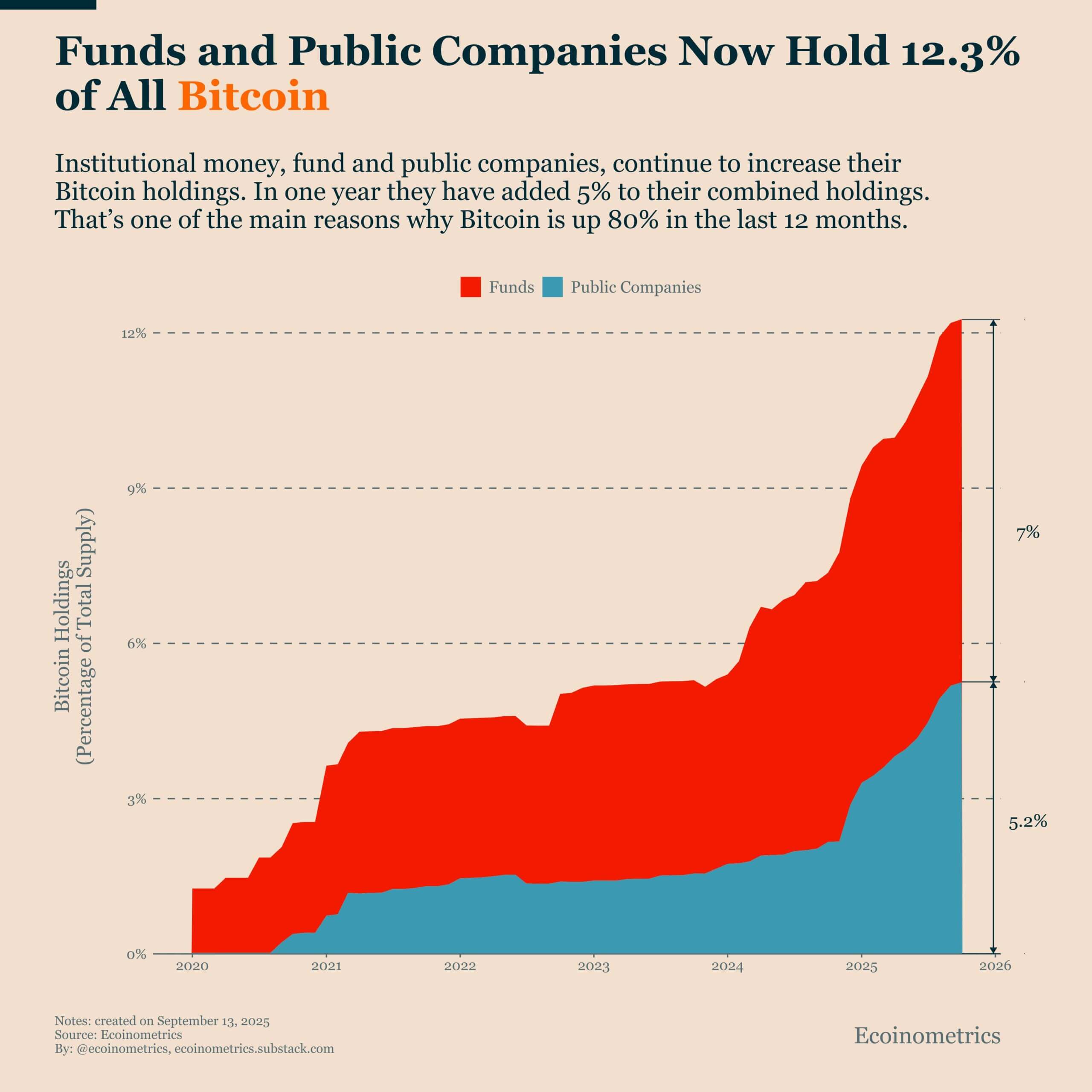

Institutions like Strategy and Metaplanet now hold 12.3% of the total Bitcoin supply

Institutional money, funds, and public companies continue to increase their BTC holdings and currently control 12.3% of all Bitcoin supply. According to Bitcoin analytics platform Ecoinometrics, this figure has dramatically increased over the past 12 months. Institutional money added 5% to

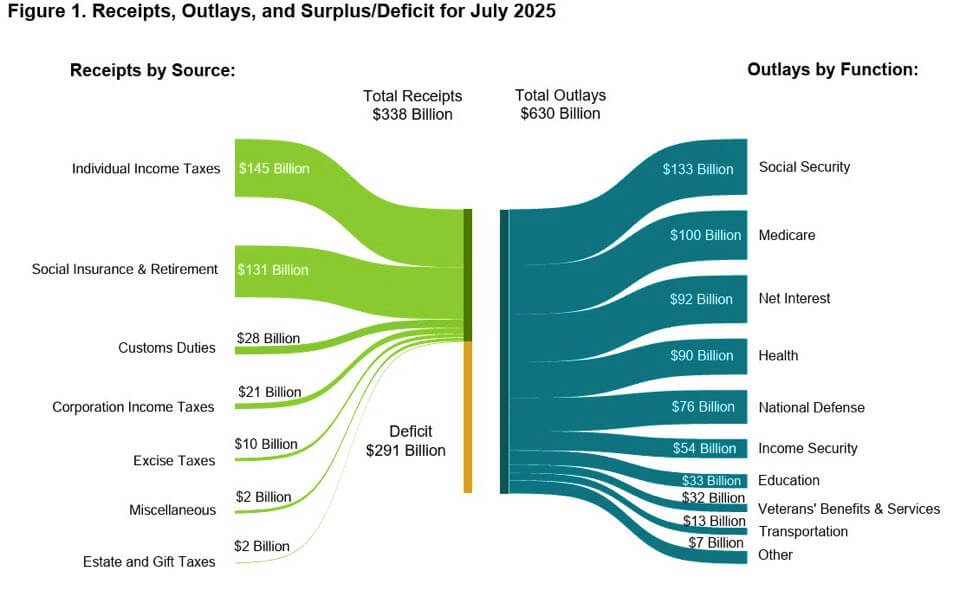

23 cents of every tax dollar goes to pay interest on U.S. debt

The United States is sitting atop a fiscal precipice. With the total U.S. debt surpassing $37.43 trillion as of September 2025, the nation faces a historic reality. Nearly one-quarter of every tax dollar it collects is consumed by servicing the

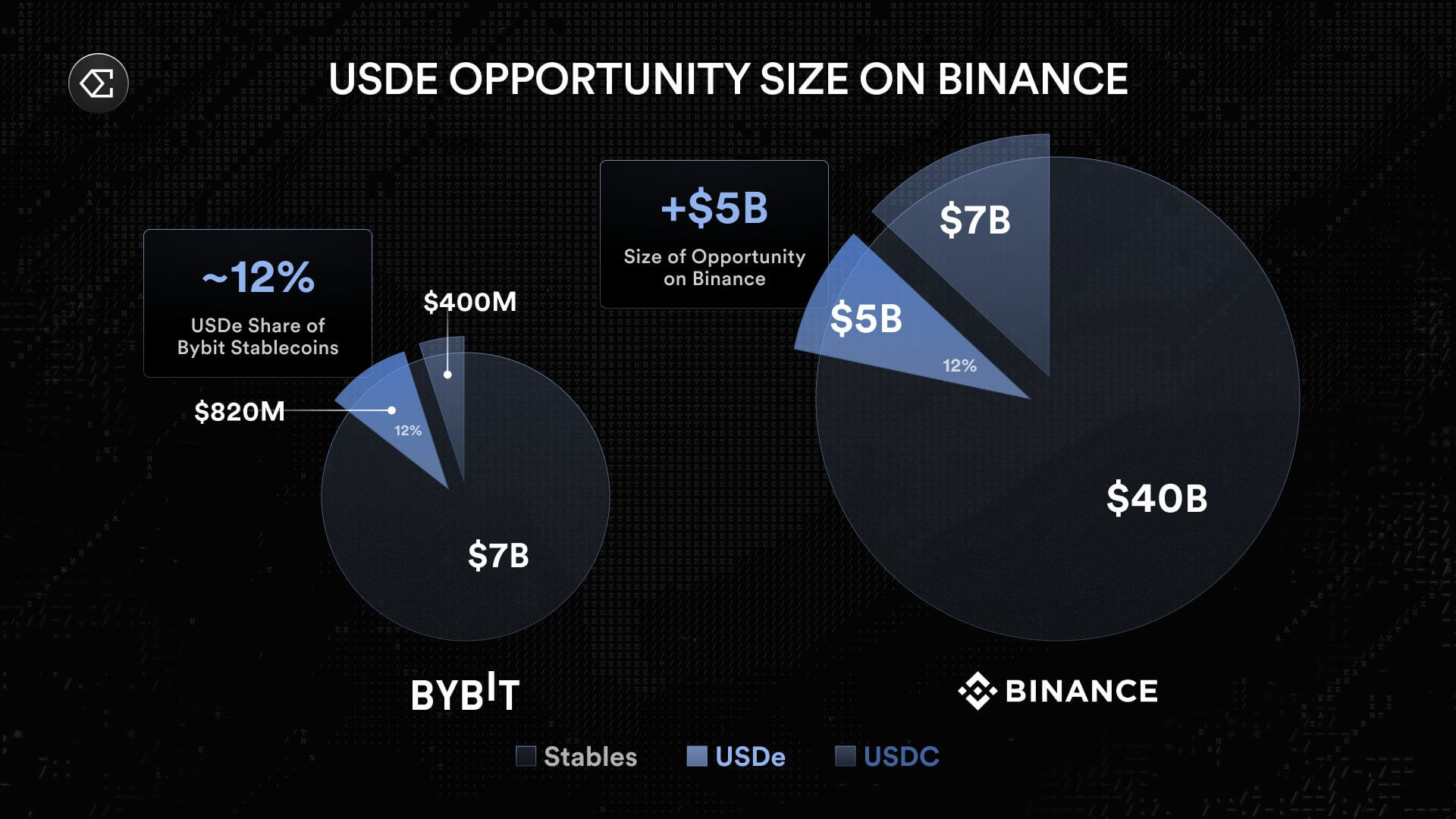

Ethena’s USDe stablecoin surges to over $13B after Binance listing

Ethena’s synthetic stablecoin, USDe, has climbed to over $13 billion in circulation less than a day after it was listed on Binance. DeFiLlama data shows supply jumped nearly 2% in 24 hours to about $13.2 billion, making it the fastest-growing stablecoin

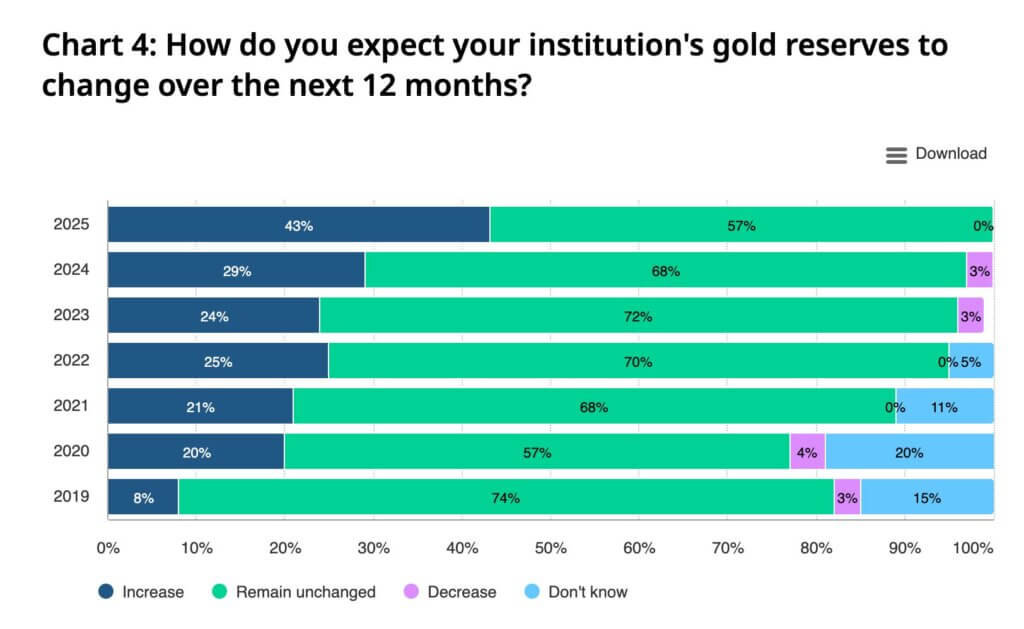

At over $3,600 an ounce, everyone’s buying gold

Everyone’s buying gold. The boomer rock blasted past $3,600 this week to mark a fresh all-time high and draw investors far and wide into its glittery orbit. So why is the gold price surging? It’s the result of a perfect storm:

From Jamie Dimon to Donald Trump: Why everyone eventually understands Bitcoin

It may take a minute to get to grips with magic internet money, but once you see the scarcity, durability, and predictability, it somehow all falls into place. From Jamie Dimon to Donald Trump, eventually everyone understands Bitcoin. Eventually everyone understands