Ethereum’s massive fee shock: New post-quantum signatures are 40x larger, threatening to crush network throughput and user costs

Ethereum elevated post-quantum cryptography to a top strategic priority this month, forming a dedicated PQ team led by Thomas Coratger and announcing $1 million in prizes to harden hash-based primitives. The announcement came one day before a16z crypto published a roadmap

Bitcoin faces slide to $60,000 if impending US shutdown triggers a statistical blackout

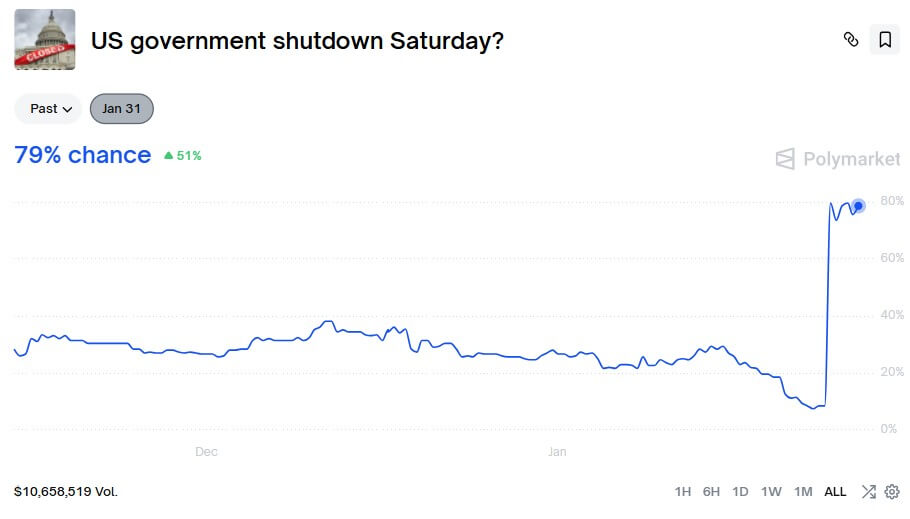

Bitcoin traders are aggressively positioning for a US government shutdown that could begin Jan. 31 if Congress fails to extend funding that expires Jan. 30. The urgency of the setup is visible in prediction markets, where odds changes have become tradable

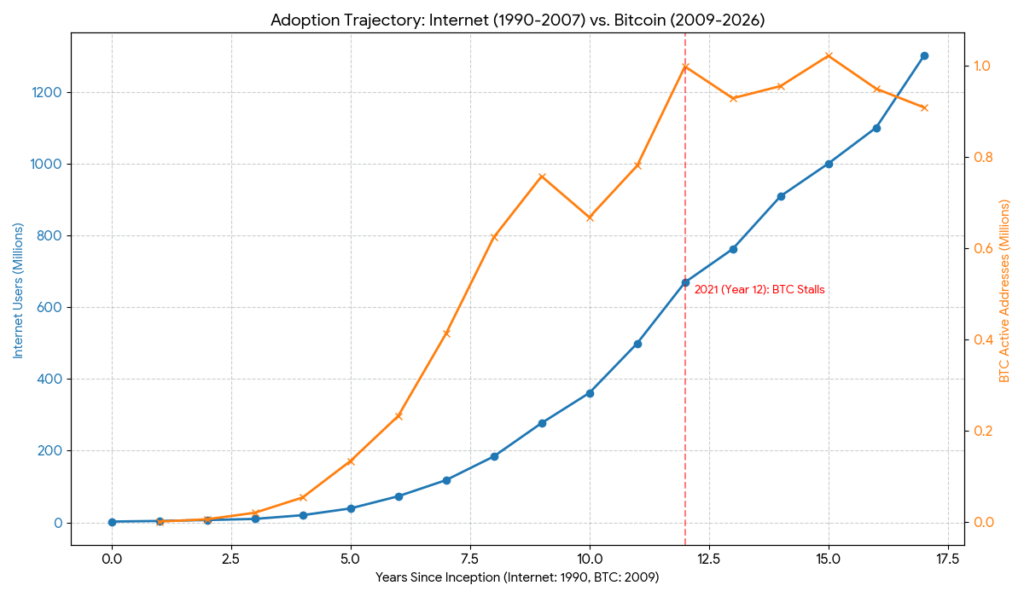

Bitcoin breaking above $100k silently broke its positive adoption curve as usage craters

Bitcoin Is Being Bought, Not Used For most of Bitcoin’s history, price and usage told broadly the same story. When price moved higher, more people showed up. More wallets became active. More transactions hit the chain. The relationship was never perfect, but

Vitalik Buterin admits his biggest design mistake since 2017 – so is your Ethereum at risk?

Vitalik Buterin said he no longer agrees with his 2017 tweet that downplayed the need for users to personally verify Ethereum end-to-end. This week, he argued the network should treat self-hosted verification as a non-negotiable escape hatch as its architecture gets

Take away the violent weekends and Bitcoin’s bull run is still alive while the dollar continues to fall

Bitcoin’s 2026 problem is the weekend I keep coming back to this line because it feels brutally true in the way only markets can be true. The only thing worse than buying Bitcoin this year was not buying Bitcoin. If you held

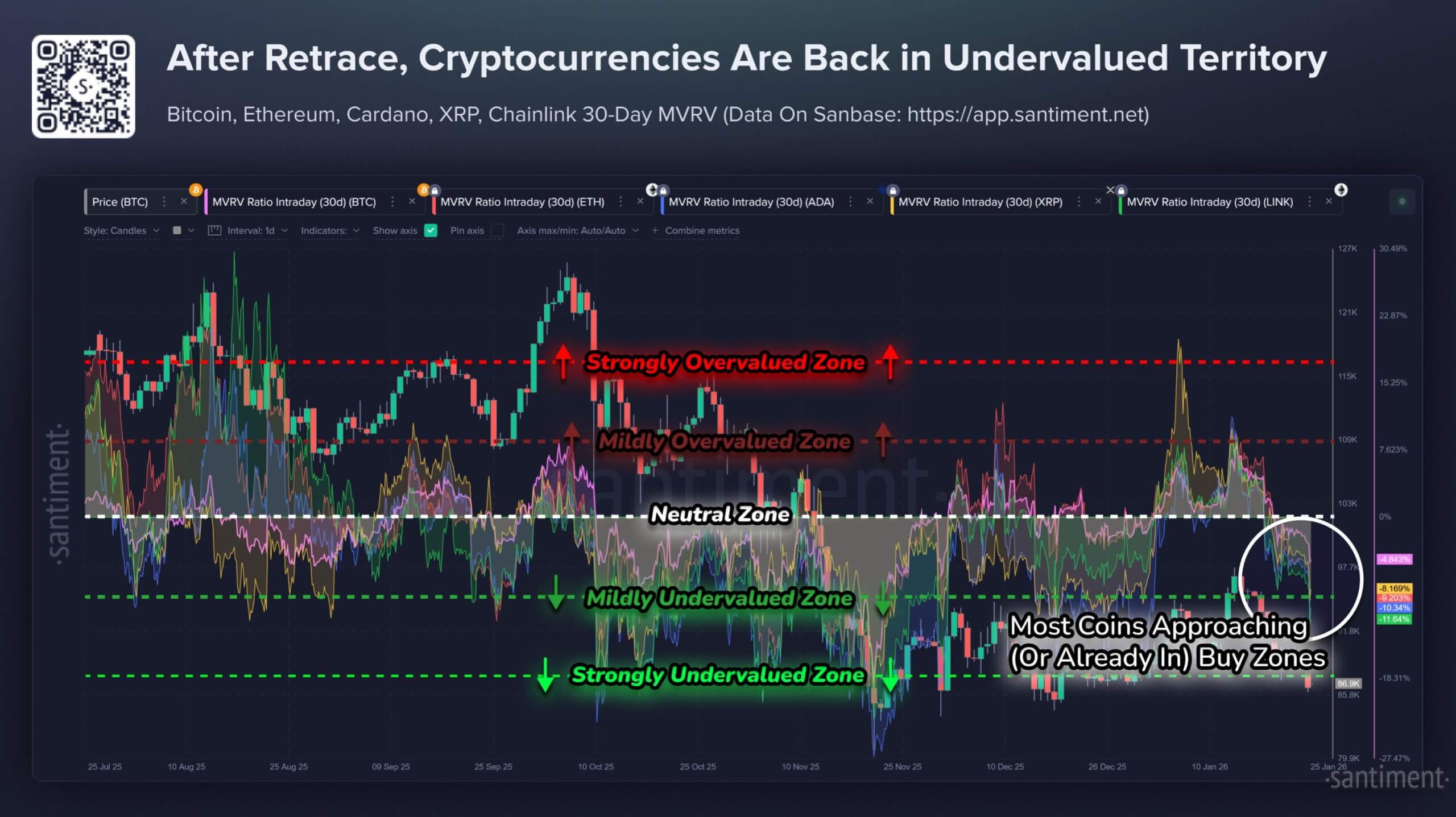

Traders panic sell XRP even though a rare “buy signal” reveals Wall Street is buying up the distressed supply

The crypto market is flashing a rare signal for XRP, suggesting the asset may be undervalued and presenting a potential buying opportunity for investors. Data from blockchain analytical firm Santiment shows that XRP’s 30-day Market Value to Realized Value (MVRV) is

Bitcoin hashrate collapses weakening security as major mining pool drops 30% of its power

One thing we rarely think about is how bad weather can affect Bitcoin's security, but it happens fairly regularly. Snow can legitimately pose a risk to Bitcoin miners who secure the blockchain. The snow shows up on the weather map first,

Disastrous Bitcoin losses loom this week as the Fed’s hidden liquidity trap threatens to drain markets despite a rate hold

Bitcoin traders will parse Federal Reserve guidance on Jan. 28 for signals on real yields, the dollar, and dollar-liquidity plumbing. Those channels can move spot prices even if the policy-rate corridor is unchanged. The Fed’s calendar shows the Federal Open Market

The next Bitcoin all-time high has a clear 3 year window but a brutal $1.3 billion exodus changes everything today

Bitcoin’s path back to a new all-time high and subsequent price discovery is being set by whether spot ETF flows turn persistent again after a two-way start to 2026 that tested how “sticky” institutional demand is in the post-ETF era. CryptoSlate

Security of the US government’s $28B Bitcoin reserve threatened after weekend theft reveals flaw

The US government has been trying to execute a historic pivot with its Bitcoin holdings, shifting from a messy, case-by-case inventory of seized crypto into a strategic national reserve for almost a year now. That ambition, often framed as a “digital

Explosive truth behind crypto bots that front-run thieves to “save” funds — but they decide who gets paid back

Makina Finance lost 1,299 ETH, roughly $4.13 million, in a flash-loan and oracle manipulation exploit. The attacker drained the protocol's funds and broadcast the transaction to Ethereum's public mempool, where it should have been picked up by validators and included in

Bitcoin trades bleed cash during these “toxic” hours because market depth is a total illusion right now

Institutions have learned to live with Bitcoin’s volatility because volatility is measurable and, for many strategies, manageable. What still holds back large allocations is the risk of moving the market while getting in or out. A fund can hedge price swings

Terrifying Solana flaw just exposed how easily the “always-on” network could have been stalled by hackers

When Solana maintainers told validators to move quickly on Agave v3.0.14, the message arrived with more urgency than detail. The Solana Status account called the release “urgent” and said it contained a “critical set of patches” for Mainnet Beta validators. Within a

Will your crypto rewards survive upcoming CLARITY law? A plain-English guide to Section 404

The Digital Asset Market Clarity Act, better known as the CLARITY Act, was supposed to draw clean lines around crypto assets and which regulator gets the first call. CryptoSlate has already walked readers through the bill’s larger architecture ahead of the

How BlackRock just lost control of the $10B tokenized Treasury market to Circle for one simple, mechanical reason

Tokenized US Treasuries crossed $10 billion in total value this week, a milestone that confirms the category has moved from proof-of-concept to operational infrastructure. Yet, something happening underneath this achievement is just as important: Circle's USYC has edged past BlackRock's BUIDL

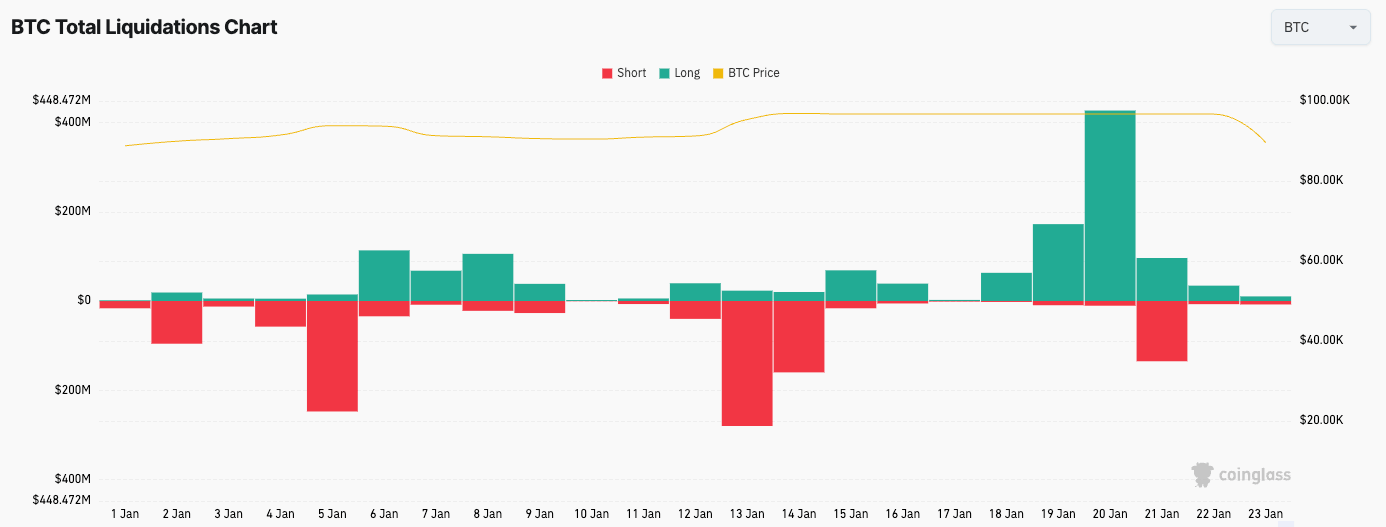

Bitcoin is trapped on a “liquidation treadmill” where risky positions are being systematically hunted

Bitcoin’s recent price action had a familiar signature: leverage built on the bounce, funding turned supportive for longs, then the market ran the nearest pockets of fragility until forced selling took over. BTC bouncing up and down in the $80,000 range

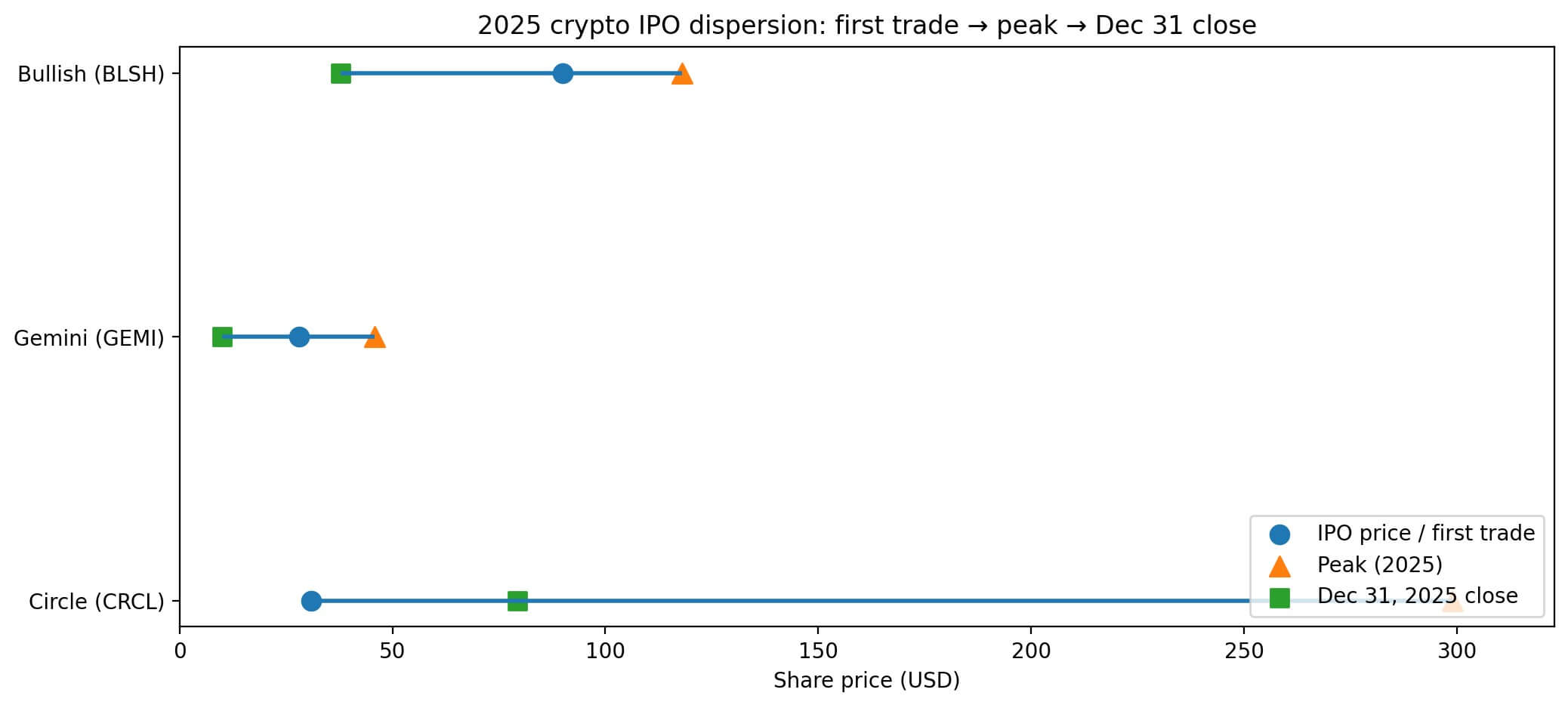

New explosive IPO surge proves smart money has abandoned high-risk tokens for this specific safe haven

Crypto's IPO market is back, but the companies leading the charge aren't the ones most exposed to token volatility. BitGo priced its initial public offering on Jan. 21 at $18 per share, raising $212.8 million and valuing the custody platform at

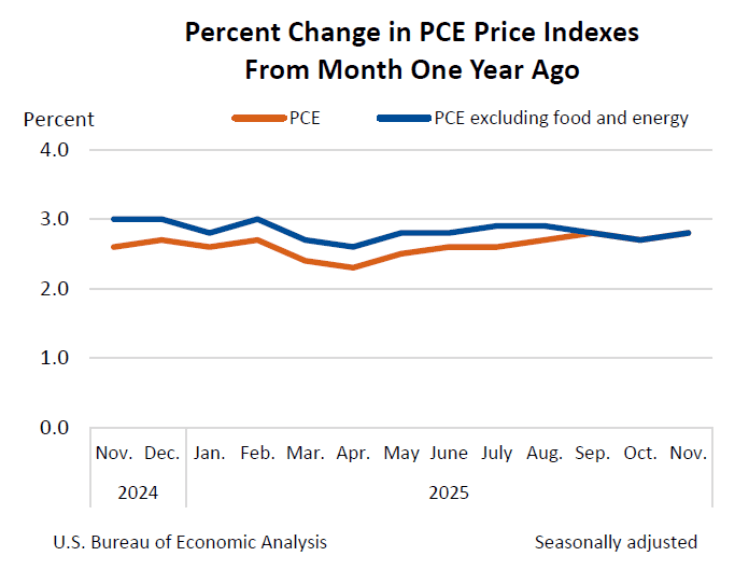

Hidden inflation risks are lurking in “patched” data, leaving Bitcoin stuck in a high-stakes waiting game

The Bureau of Economic Analysis (BEA) released its delayed Personal Income and Outlays report on Jan. 22, publishing October and November PCE inflation together. The print put headline PCE at 0.2% month over month in both months, with headline PCE at